Competitor Analysis: The Complete Beginner’s Guide

Written by Leigh McKenzieIn collaboration with Semrush

As more businesses launch and expand each year, competition is perpetually increasing.

Simply having a good product or service doesn’t cut it anymore. You need a rock-solid differentiation strategy.

And that’s where competitor analysis comes in.

Just ask food safety solution, LiberEat.

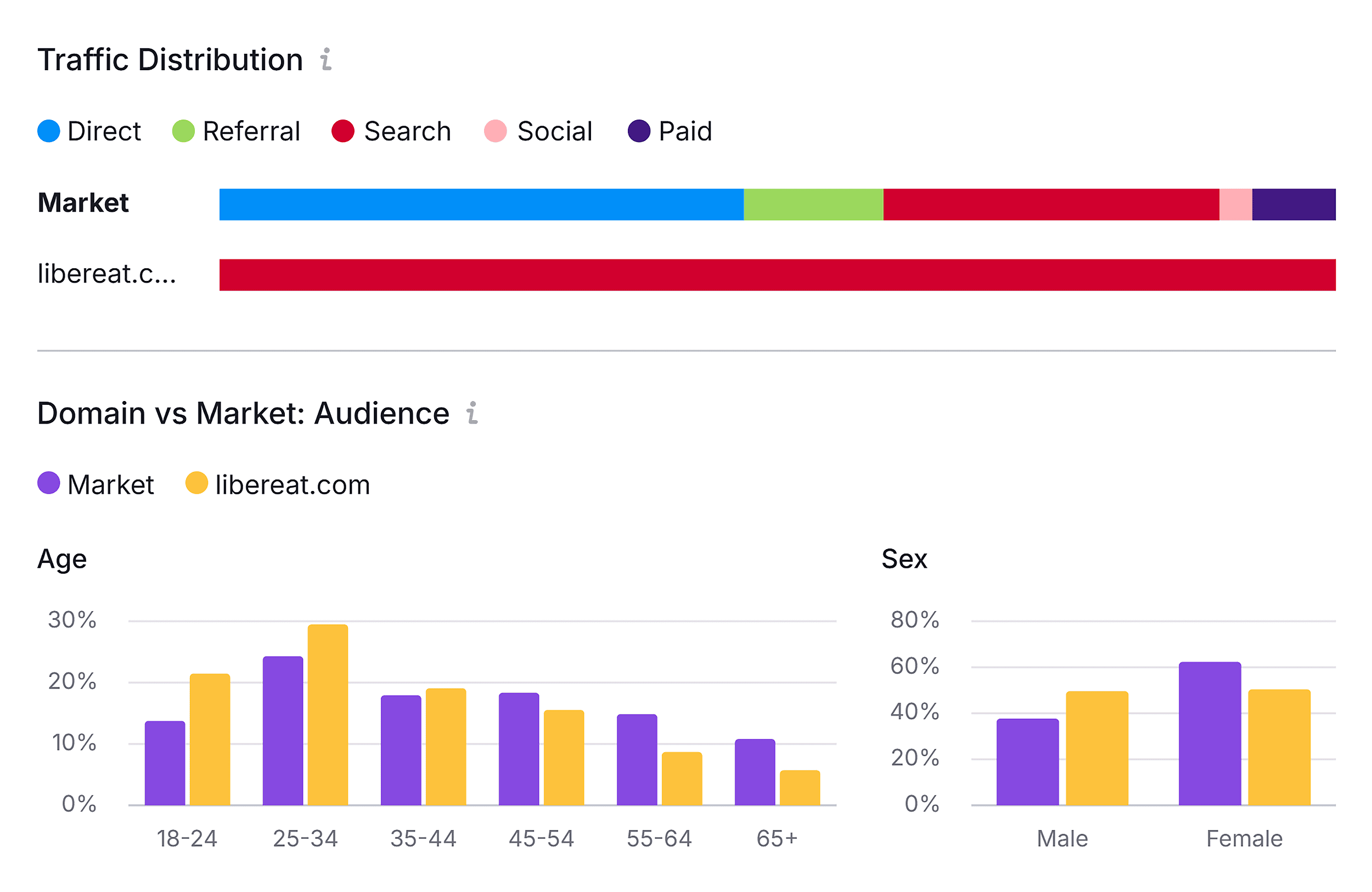

Faced with the challenge of growing their user base without relying on ads, the company turned to SEO.

LiberEat’s team analyzed competitors and created content that addressed its differentiators and audience’s needs.

Within just three months, its website traffic surged tenfold, and organic conversions jumped by 25%.

Compared to other industry players, LiberEat was the only website that received 100% of its traffic share from organic search—completely outpacing the market.

That’s the power of competitor analysis.

If you want similar results, you’re in the right place. In this guide, we’ll explore:

- What competitor analysis is

- Who benefits from this process

- How to use it for your business

What Is a Competitor Analysis?

Competitor analysis is the process of examining direct and indirect competitors to understand how your business functions and performs relative to them. You’ll research a rival’s:

- Product/service

- Market share and customer base

- Marketing/advertising strategy

- Customer sentiment

- Brand perception

- Pricing strategy

In short, it tells you if you’re underperforming or outperforming compared to your peers.

The data also lets you identify new opportunities for your business and predict your competitor’s actions. By staying ahead of market shifts, you keep a finger on the pulse—and make better business decisions.

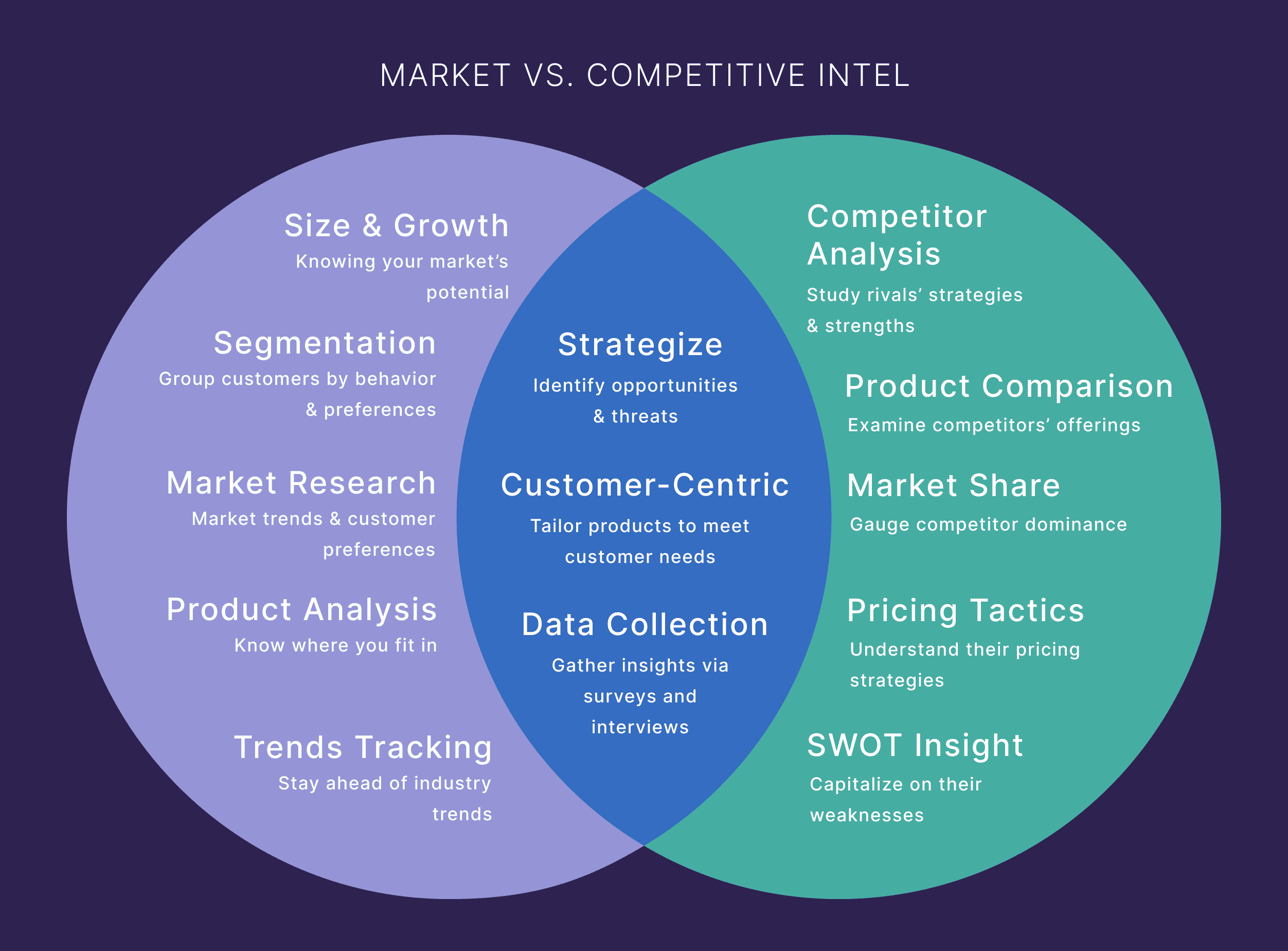

Many people use market analysis interchangeably with competitor analysis. But there’s a key difference between them.

Market analysis looks at your industry, market, competitors, and customers.

Competitor analysis narrows that focus on a slice of that—your competitors. It zeroes in on how they operate and perform.

How to Conduct a Competitor Analysis in 11 Steps

Before diving in, establish your goals.

Are you looking to discover competitors? Or do you want to improve a specific area of your business, like the product or customer experience?

Keep your answers in mind as you do the analysis.

Okay, first step.

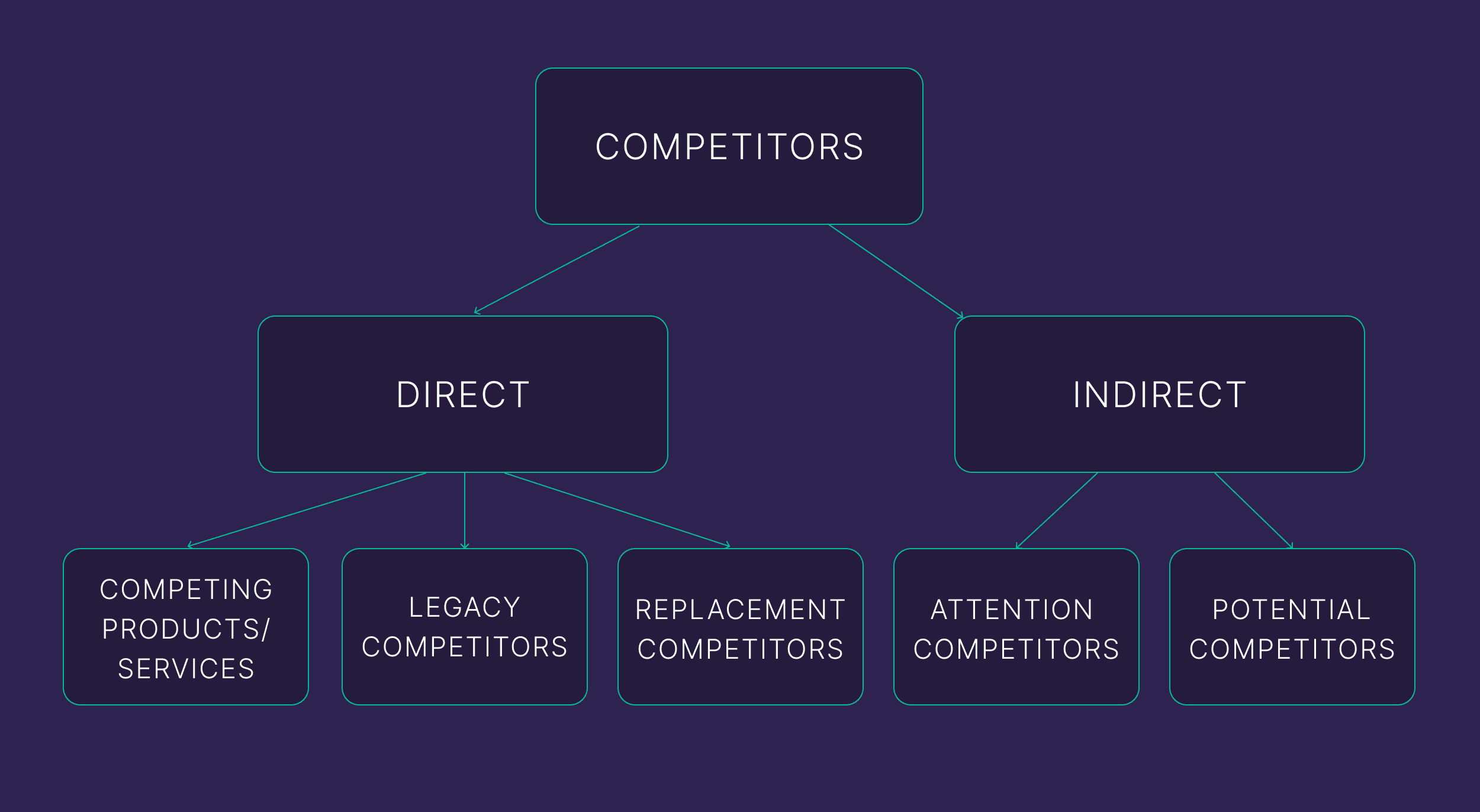

1. Identify and Categorize Your Competitors

To understand your competition, go beyond listing their names. Zoom out to see the full market picture.

Use your product/service, target market, and region as a starting point.

Try the following sources to get started:

- Search engines: Perform a Google or Bing search with relevant keywords (e.g., “yoga studio in Boston”) to see which businesses rank highest

- Customer data: Analyze customer reviews, sales calls, and surveys to discover who your audience is comparing you with

- Social media: Monitor platforms like Facebook, Reddit, and Pinterest to track which brands your target audience engages with

- Industry events: Attend trade shows or local events to identify potential competitors you may have overlooked

Collect the names of these businesses and document them extensively. Include their product/service and market segment.

Once you do that, categorize them into direct and indirect competitors.

Let’s use the example of a yoga studio to understand the difference.

Direct Competitors

Direct competitors offer the same product/service and target the same customer base.

- Competing brands: Businesses offering similar services—like another yoga studio

- Legacy competitors: Products/services your customers have used or are currently using (e.g., traditional wellness or yoga studios)

- Replacement competitors: Products/services that could replace yours but don’t always target your customer base (e.g., a personal yoga trainer)

Indirect Competitors

Indirect competitors offer an adjacent service but for the same customer base.

- Attention competitors: Compete for your audience’s attention or budget but don’t offer the same product/service (e.g., Tai Chi or wellness centers)

- Potential competitors: Businesses that could become competitive, especially those in adjacent markets or audiences (e.g., a gym that starts offering yoga sessions)

For example, let’s say you’re going to market your yoga studio soon. Start with a Google search using terms like “yoga studio in boston.”

Next, review the top results and note the services each studio offers.

For example, Back Bay Yoga Union features group sessions, at-home virtual sessions, and teacher training sessions. So if you offer any of these services, they would be a direct competitor.

If you offer a newer variety of yoga—like chair yoga or similar—they would be a legacy competitor.

You can get even more granular with Semrush’s Organic Research tool.

Sign up for a 14-day pro trial and click the “Competitors” tab. It’ll show you a list of websites directly competing for visibility in search engines.

Use this data to further dig into each website and its offerings.

The goal is to find as many businesses as possible that could be relevant to yours.

Ask yourself: How can I serve this market better? What needs are being overlooked?

By doing so, you’ll start to see opportunities to carve out a unique position and set your business apart from the competition.

2. Study Your Competitor’s Customer Segments

After you’ve documented your competitors, look into who they cater to.

You want to identify:

- Their ideal customers

- Specific markets they target

- What needs they address

- How they position products

Their website is a good starting point.

Say you want to create a local food delivery app.

DoorDash would be a direct competitor, as it offers the same service for a range of local businesses.

Check the website for the types of businesses DoorDash works with to get a feel for its customer base.

Here are a few examples:

- Restaurants

- Liquor stores

- Pet stores

- Grocery/convenience stores

- Flower shops

- Retail stores

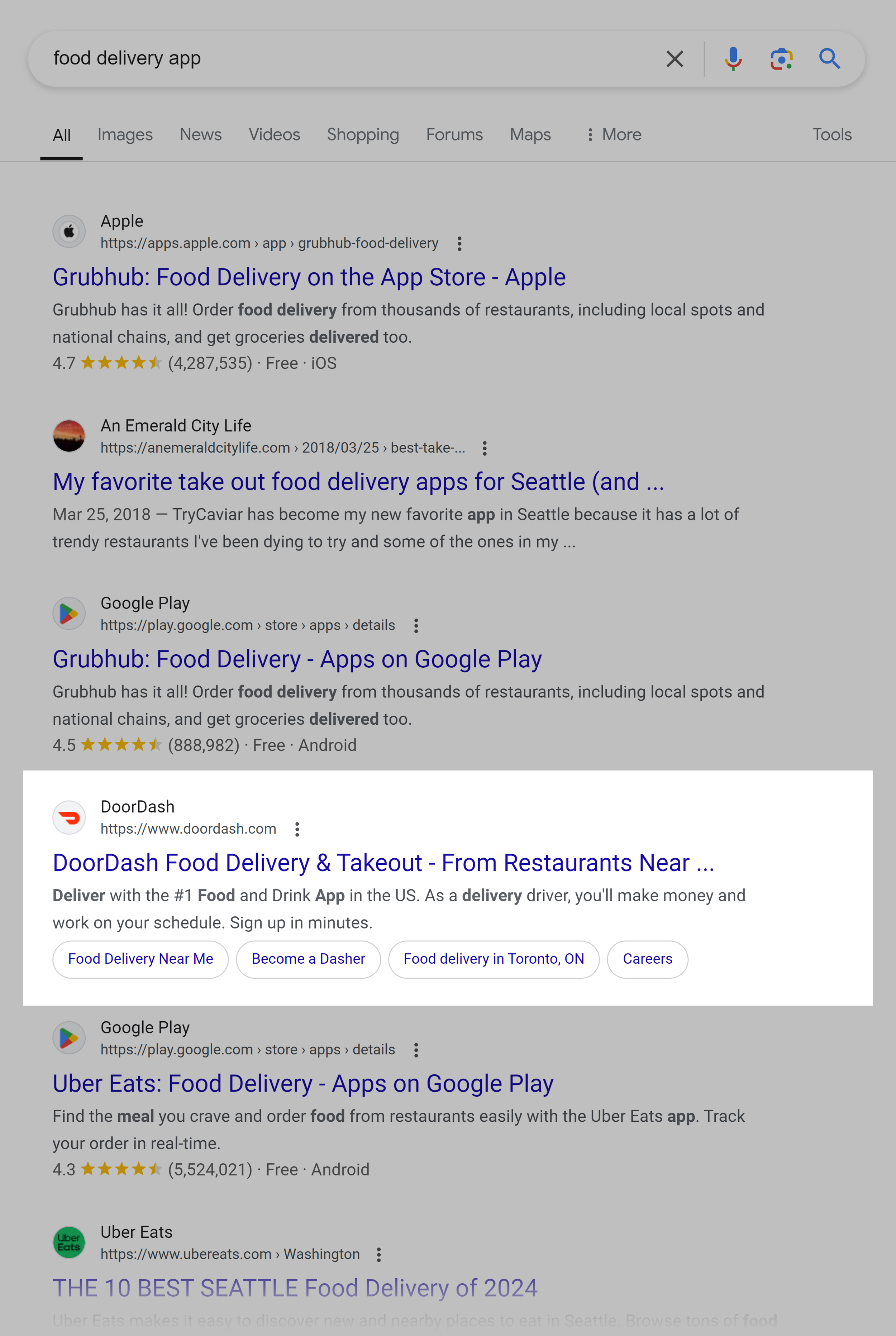

To find what a rival’s customer segment cares about, use a Google search to find topics they are interested in.

In DoorDash’s example, you would search for terms like “food delivery app” or “selling food online.”

See how DoorDash positions itself and if it ranks for these terms.

You could also find other businesses that rank for such terms, indicating that they’d be competitors, too.

Once you have a list of the types of businesses DoorDash caters to, think about the specific needs these businesses have. Maybe they prioritize fast delivery times or value reliable service during peak hours.

When you understand what these segments want, you can uncover areas where DoorDash falls short. And use that to differentiate your app.

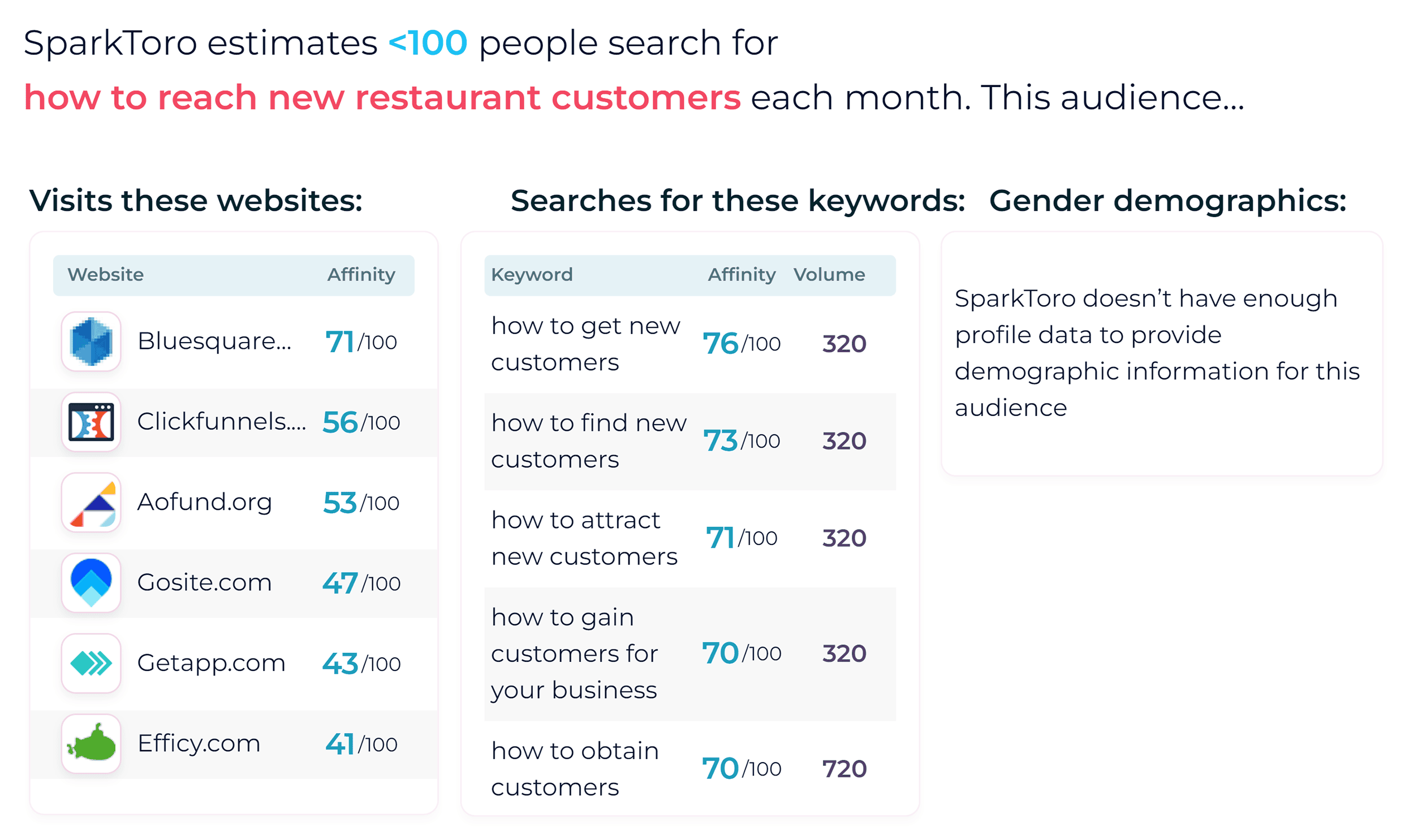

Then, use tools like Semrush or SparkToro to investigate aspects like:

- Websites they visit

- Keywords they search

- Gender demographics

- Preferred social networks

- Accounts they follow

For instance, on Sparktoro, you can research a website’s audience or keywords that could be relevant to your offer.

A quick search will give a comprehensive dataset about your audience’s preferences and movement through different websites.

This process will also show you where these customer segments actually spend time. And help you decide whether to invest in those channels.

3. Determine Their Market Share and Business Metrics

A competitor’s market share tells you two things: how much influence they have and how well they perform relative to it.

To find a company’s market share, you first need to know their revenue. You can find that through sources like:

- Search engines

- Research databases

- Press releases

- Investor reports

- Company databases (Growjo, Crunchbase)

- PitchBook

- News publications

It’s easier to find these numbers for public companies since many databases publish them.

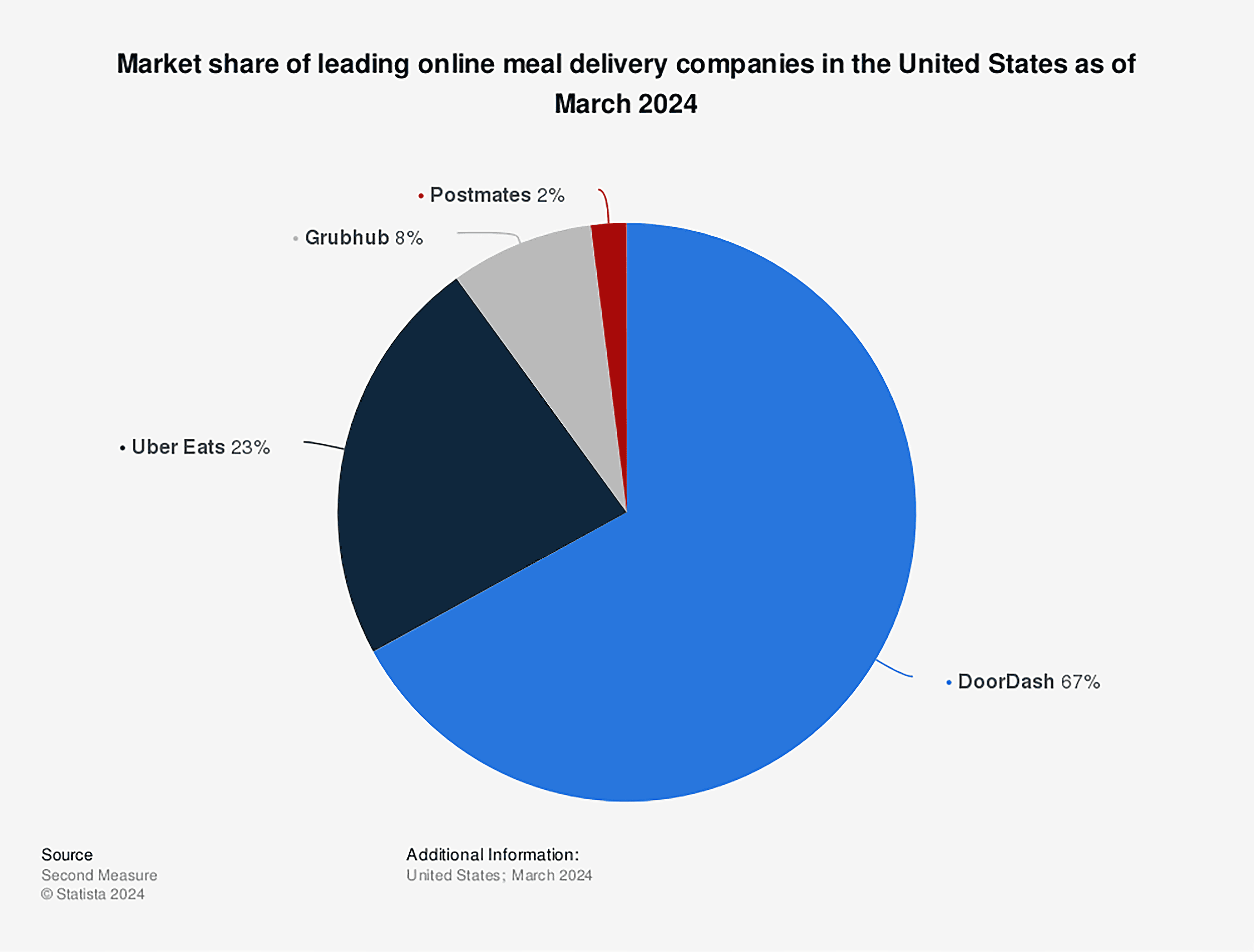

For example, DoorDash made over $8.6 billion in 2023, per Statista reports.

Here’s how to calculate it:

Market share = Total sales for [specific period] / Total industry sales for same period x 100

In this case, DoorDash currently holds a 67% market share in the United States.

Next, look into other financial data, like:

- Profit margin

- Yearly revenue growth

- Yearly market share growth

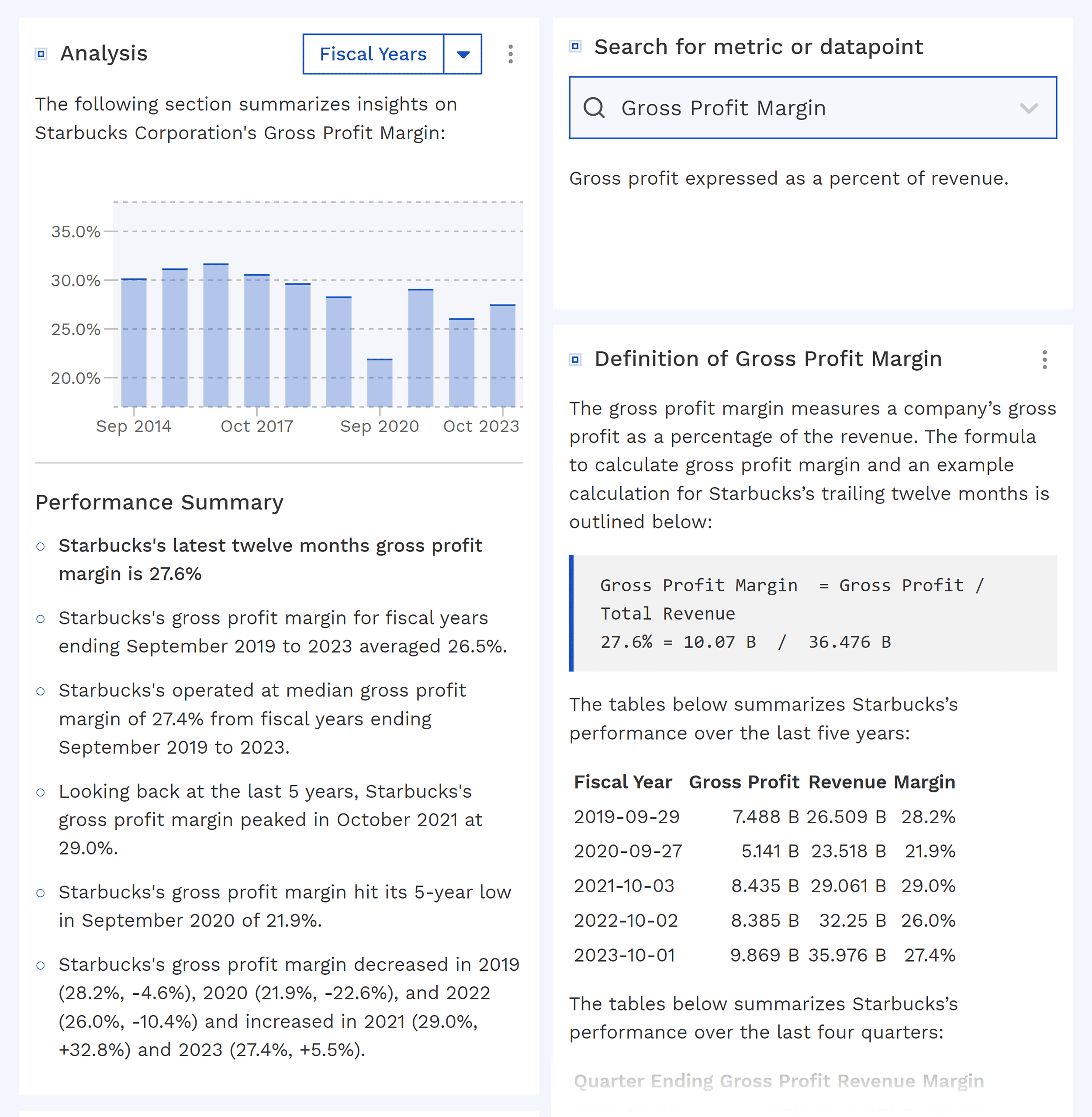

You can find that information on databases like Crunchbase and PitchBook.

For example, Starbucks acquired Teavana, a local tea retailer, in 2012.

Since doing the deal, Starbucks has experimented with offering tea products.

Recent Finbox reports show that Starbucks’ profit margins and revenue are also on an upward trend. This indicates that recent acquisitions and investments in similar products are paying off.

Remember: Don’t just collect data—use it.

Benchmark your performance against competitors, identify areas for improvement, and spot market opportunities.

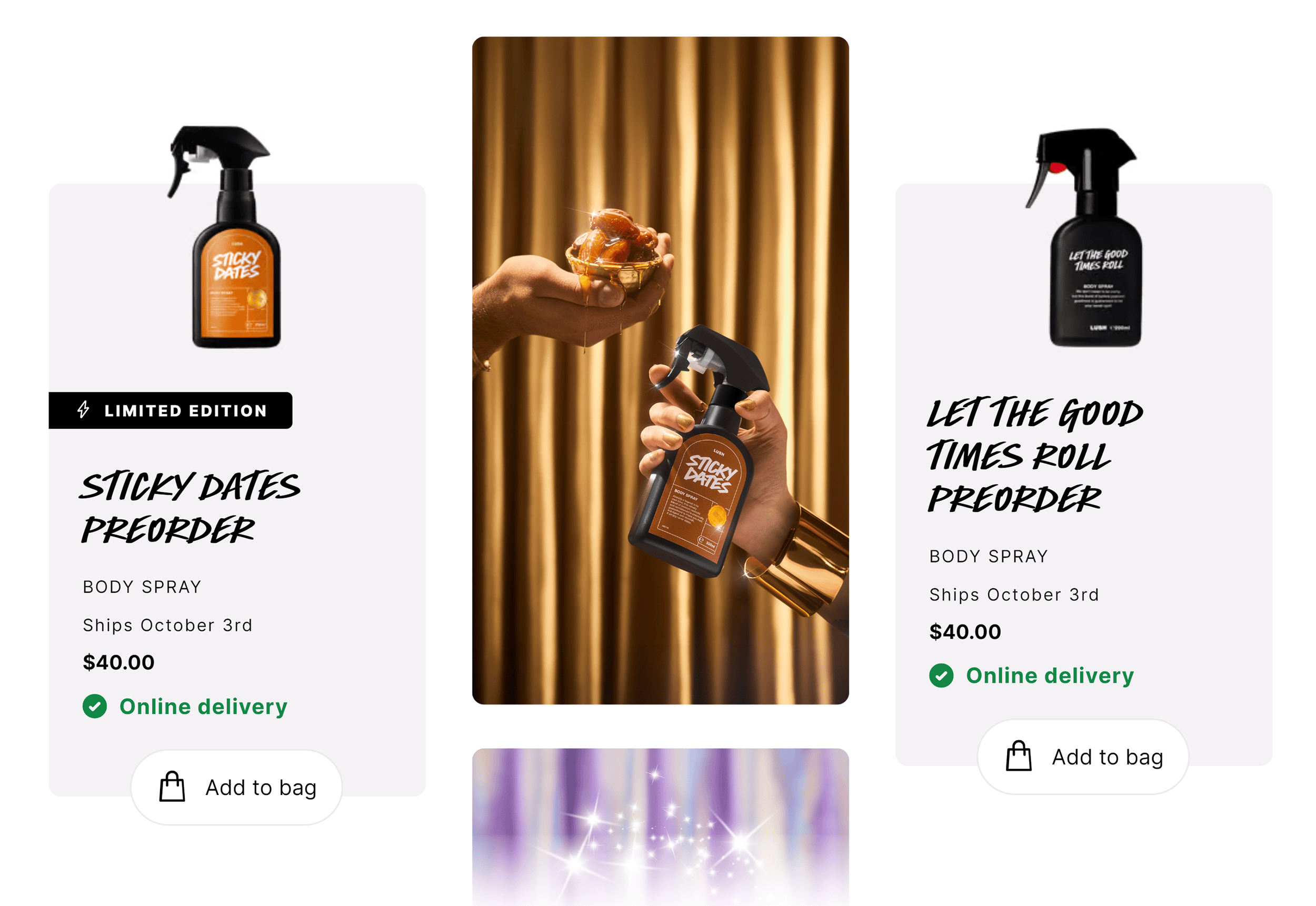

4. Research Their Product or Service

It can be hard to see what makes you different unless you know the true capabilities of a competitor’s product or service.

So, start by listing its:

- Product types

- Features

- Benefits

- Outcomes

- Unique selling points

- Best-selling/primary products or services

Find these on the competitor’s website or social media profiles.

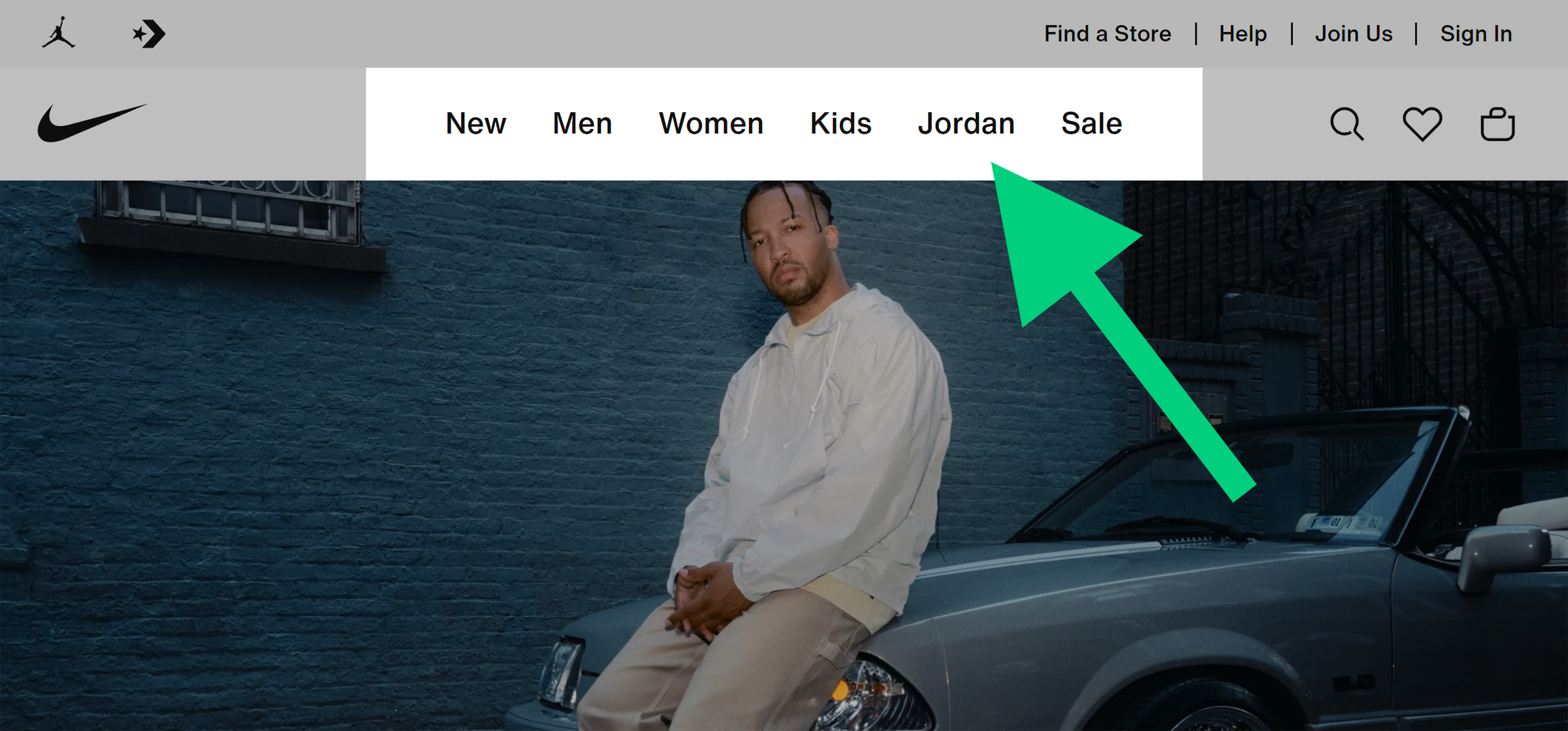

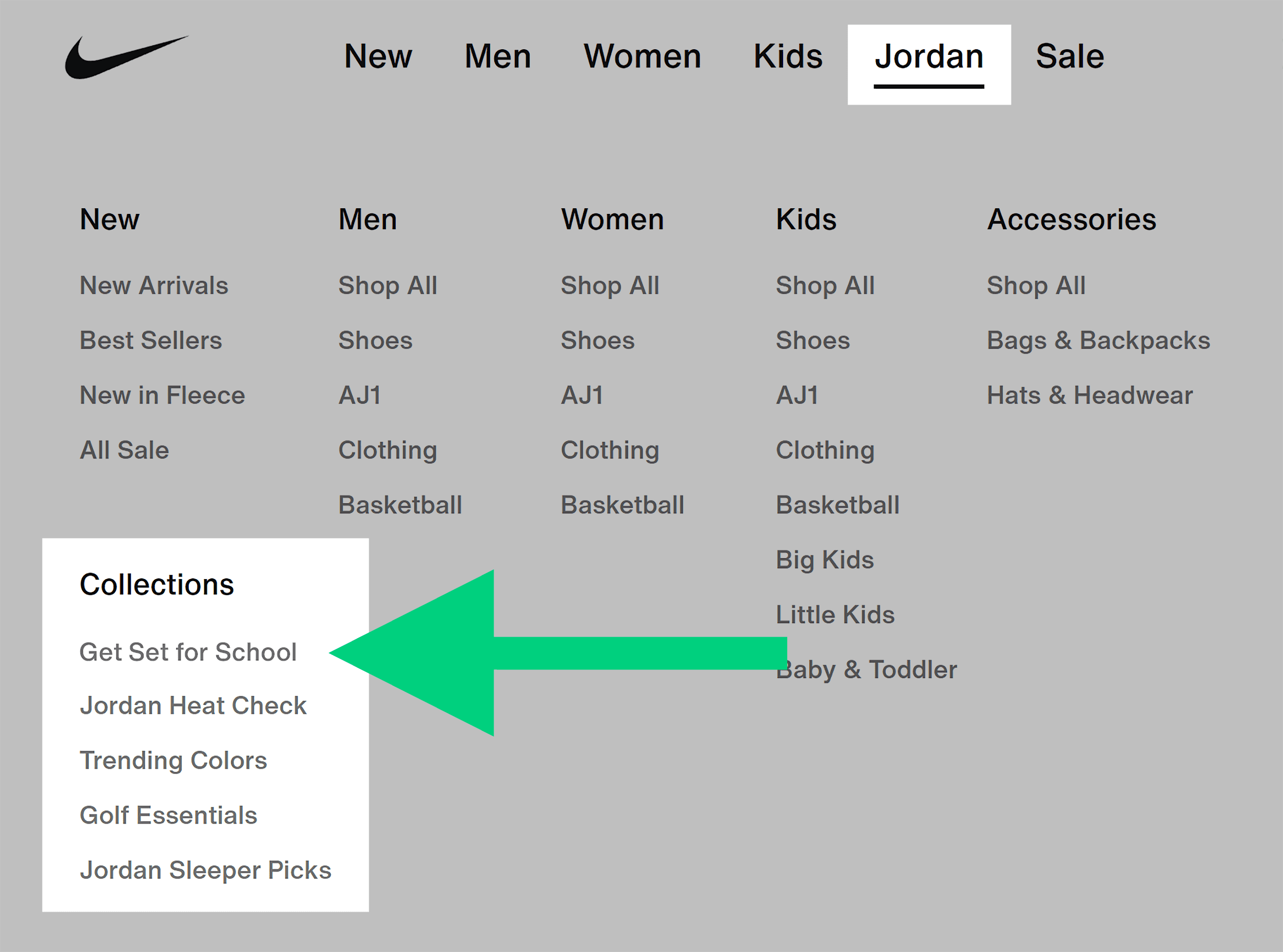

For example, Nike’s website navigation (as of September 2024) shows that the brand currently prioritizes its Jordan collection.

This could be because it’s highly profitable, best-selling, or trending at the moment.

Its “Get Set for School” collection targets the back-to-school season, which could lead to increased sales among students returning to school.

Similarly, you could create separate categories for your best-selling products or add bundled offers to increase the average order value during peak periods.

Apart from your competitor’s website, use the following sources:

- Third-party review sites: Check reviews on sites like Yelp or Trustpilot to see what customers appreciate or dislike about the products

- Third-party sellers: Observe how competitors’ products are presented and reviewed on platforms like Amazon

- Ads: Analyze the messaging and positioning in ads on Google or Meta to understand their marketing strategy

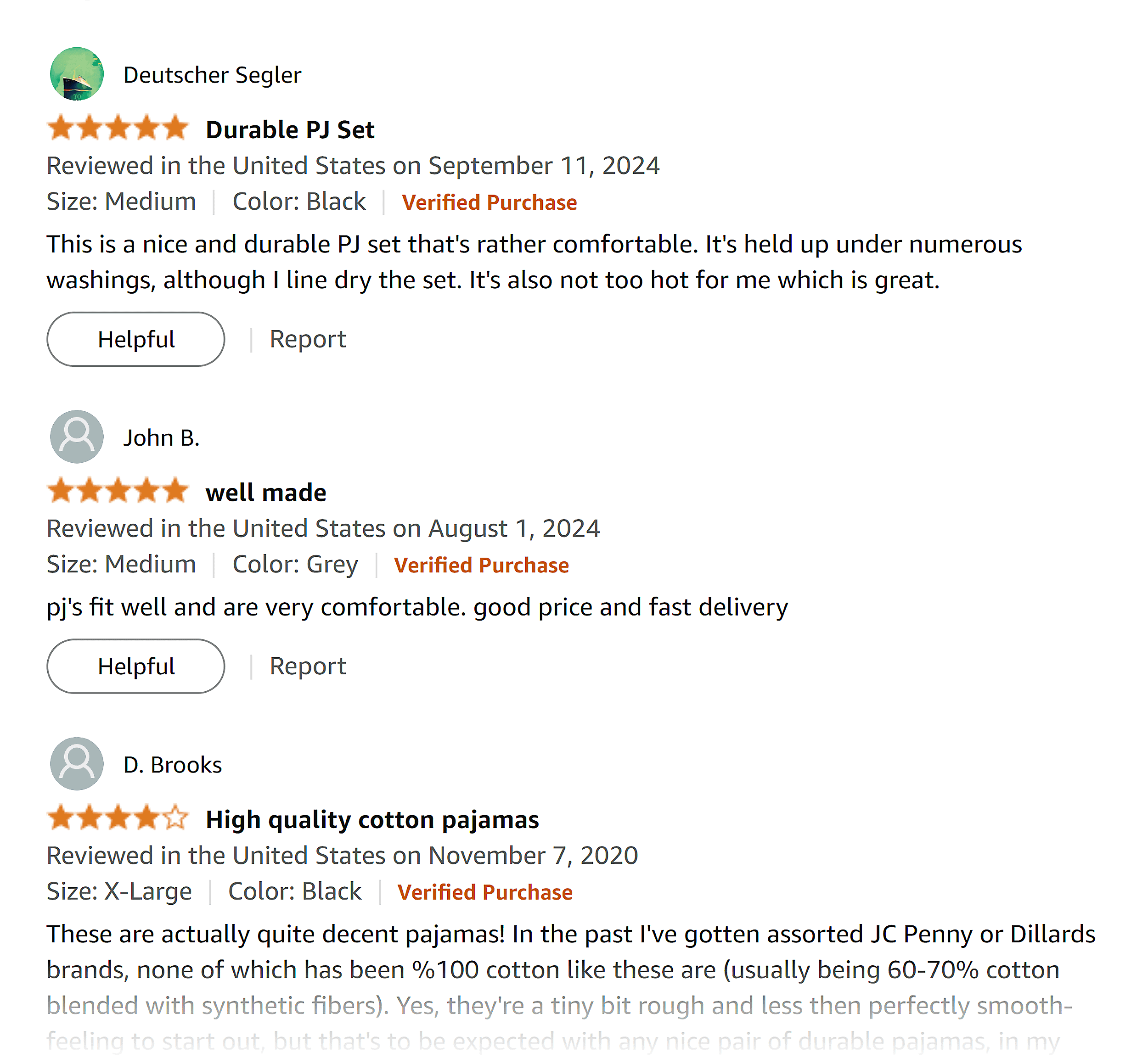

For example, Tony and Candice’s men’s sleepwear product has thousands of reviews, mostly positive.

On its Amazon storefront, customers praise the product’s appearance, quality, and warmth. If you want to outdo them, prioritize these aspects in your production process.

The sources you use also depend on the industry you’re in.

For instance, in the technical space, academic publications and Github repositories are excellent sources of product knowledge.

For industries focused on consumer goods, customer reviews and social media platforms can provide invaluable insights.

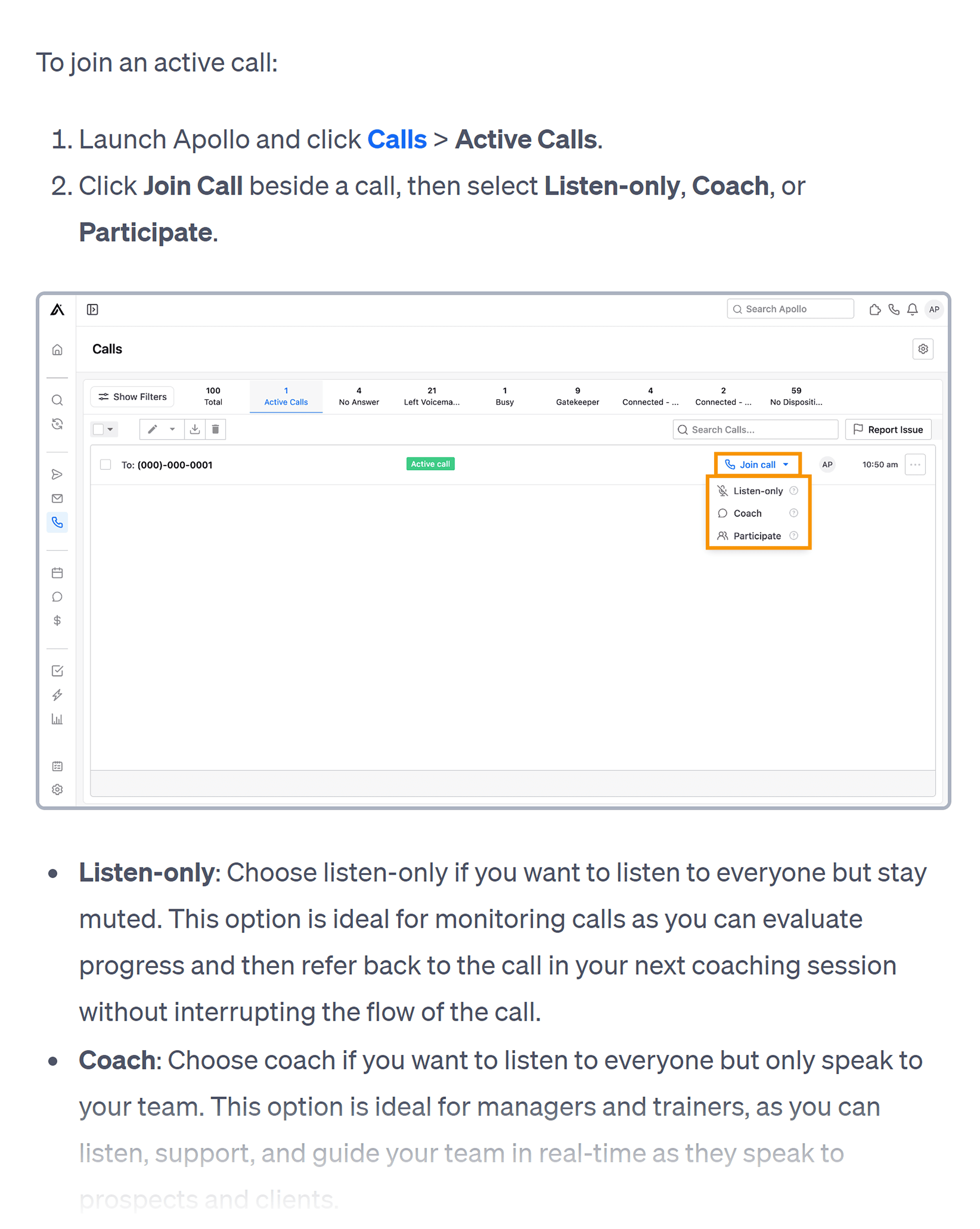

You could also review help centers to get more in-depth information. They include in-depth walkthroughs of the product or service, along with answers to most frequently asked questions.

Andy McCotter-Bicknell, head of competitive intelligence at Apollo.io, says help centers are one of the most underrated sources of product knowledge.

Why?

Because they offer less fluff and more tactical product details than a marketing site.

For example, the image below shows how to join an active call using Apollo’s cold calling module. The help center pages give a complete rundown on the available features and a few-step process for joining calls.

If you’re building a similar solution, you can find ways to differentiate your product’s cold calling module too.

Also, see if your competitors are consistently launching new products or new product versions.

The launch cycle could tell you how much they’re investing in research and development. You can anticipate how fast your rival will meet market needs. Adjust your launch cycle accordingly.

5. Observe How Competitors Price Their Product or Service

If you want to outsell your competitors, review their prices. Your pricing strategy might have gaps that stall revenue growth.

Ask yourself the following questions:

- What pricing model do they use? (Freemium, per item, etc.)

- Do they offer packaged items or subscription tiers?

- Do they position themselves as an affordable or premium option?

- What do they offer for the price point?

- Do they offer discounts or limited-time offers?

- Do they provide the exact pricing for different customer segments?

- How transparent are they about pricing?

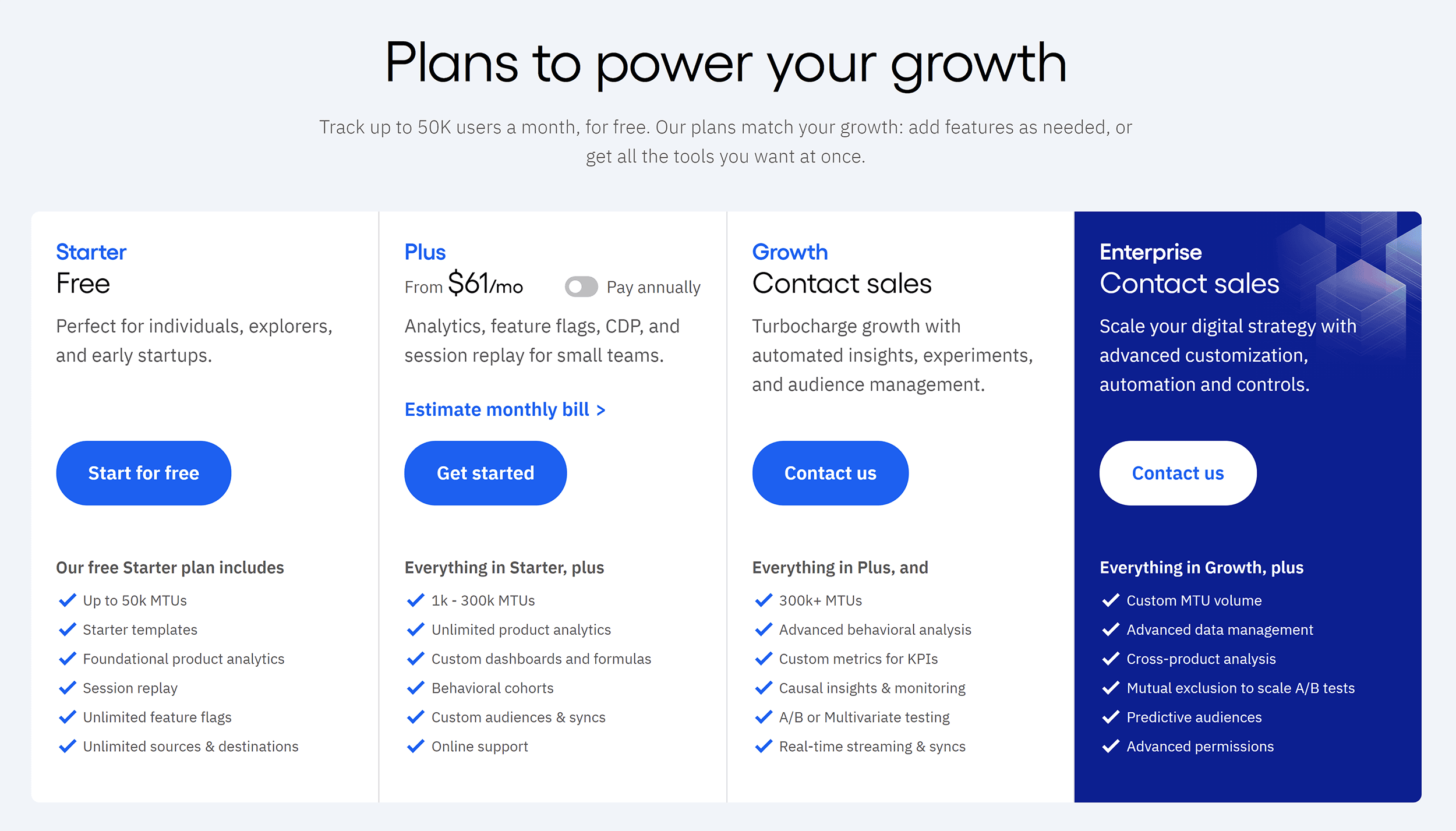

For instance, Amplitude, a software company, uses a freemium model.

They only charge for advanced analytics capabilities. The company also offers discounts for annual payments and provides a free plan for startups with less than $5 million in revenue.

It’s obvious that the company values transparency.

It tells customers exactly what they get at specific price points. And only gates pricing for enterprises that require a custom scope of work.

If you’re launching a new competing startup, this could be a pricing model to consider. It also influences how you’ll market and sell your products.

Also, look into how often competitors update their pricing.

If it’s too often, it could mean that they still haven’t figured out the right market. If it’s once every few years, they’re probably making healthy margins with existing customers.

Realizing these patterns will indicate a rival’s market confidence and long-term strategy.

6. Understand How They Market Themselves

When you look at how competitors promote themselves, you’ll understand how they acquire customers.

Here are a few questions to consider:

- How do they communicate with their audience?

- Which channels are they investing in?

- How much could they be spending on these channels?

- Do they have an active blog or social media handle?

- How often do they post and advertise?

- What kind of content do they post?

- What kind of tone do they use?

You can do a manual search through Google or popular social platforms.

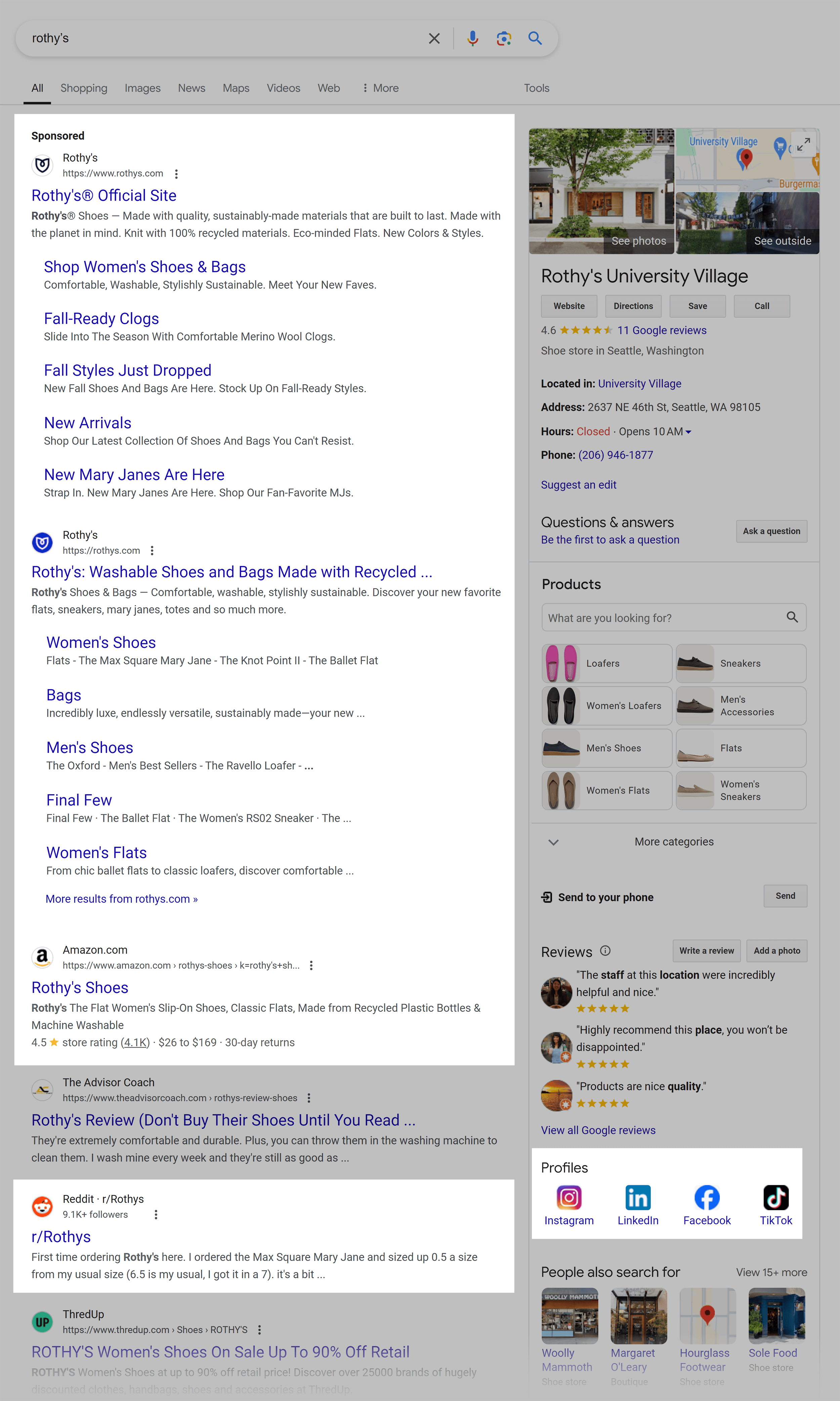

Let’s take Rothy’s—a shoes and accessories brand—as an example.

A quick Google search shows that the brand invests in:

- Search Engine Optimization (SEO)

- Google Ads

- YouTube

- Amazon

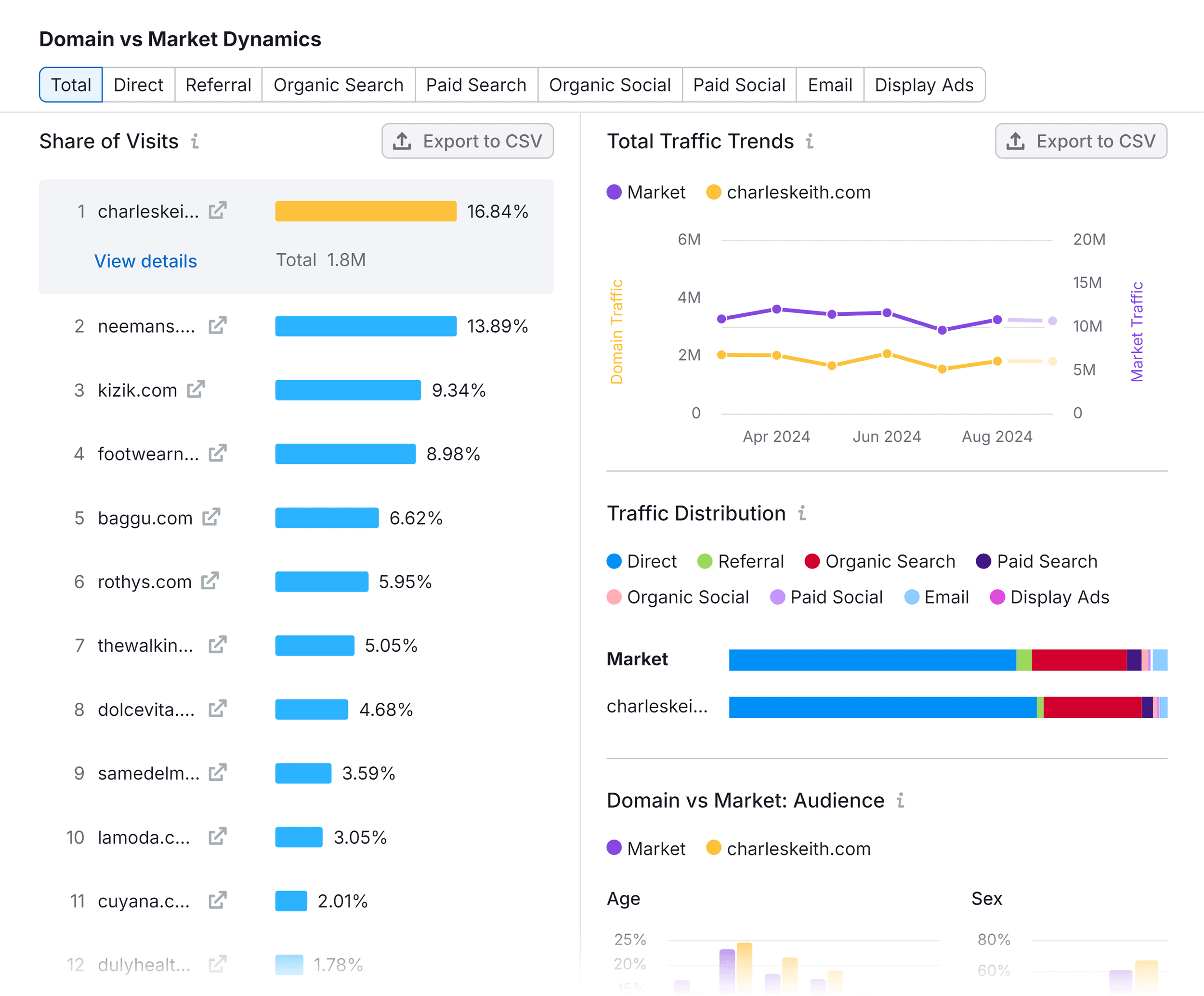

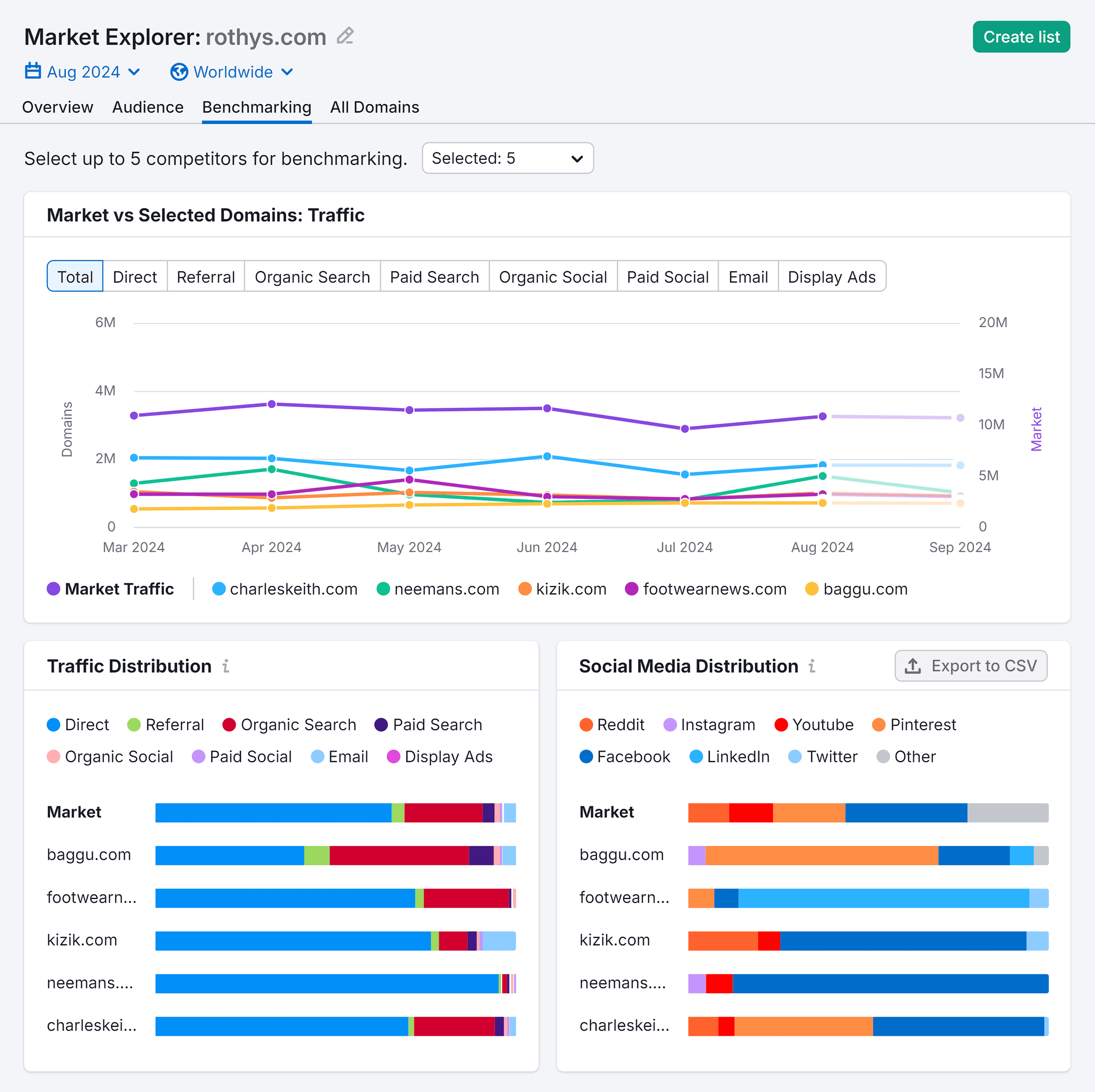

If you want to see where it gets the most traffic, use Semrush’s Market Explorer tool.

The data shows that organic search plays a huge role in Rothy’s website’s traffic. So, dig into its content and SEO strategy.

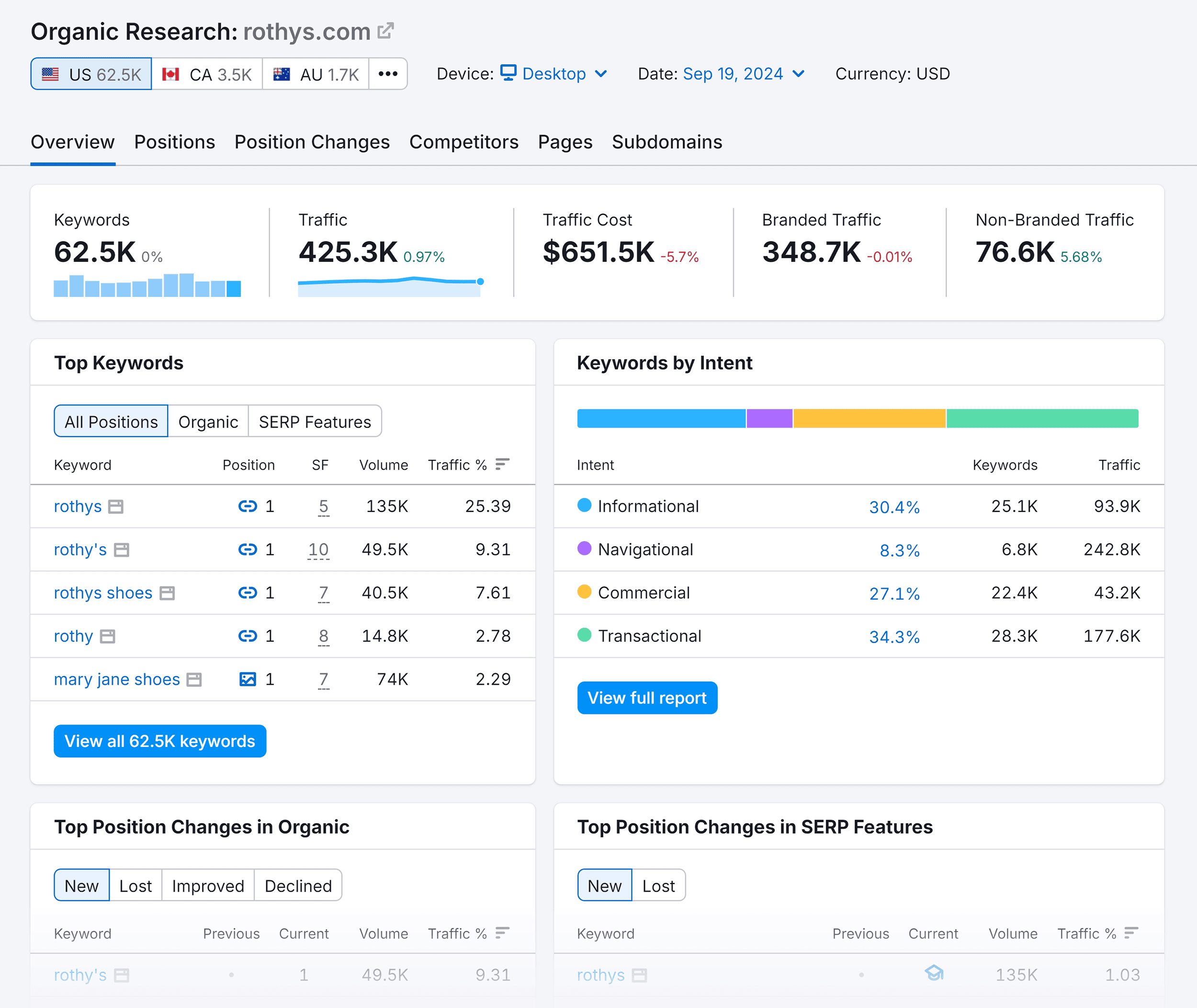

Identify which terms they rank for, how much traffic specific keywords bring in, and what content gaps exist between your website and Rothy’s.

Use Semrush’s Organic Research tool to analyze their top-performing keywords and pinpoint opportunities to optimize your content.

Here’s how:

Launch the tool, enter your competitor’s URL, select the region, and click “Search.”

The tool will display a detailed report of your competitor’s organic search performance, including their top-ranking keywords, traffic volume, and more.

Then, use this data to identify opportunities to improve your own content strategy.

For instance, by targeting high-performing keywords and addressing content gaps, you can improve your search rankings, increase organic traffic, and better compete with sites like Rothy’s.

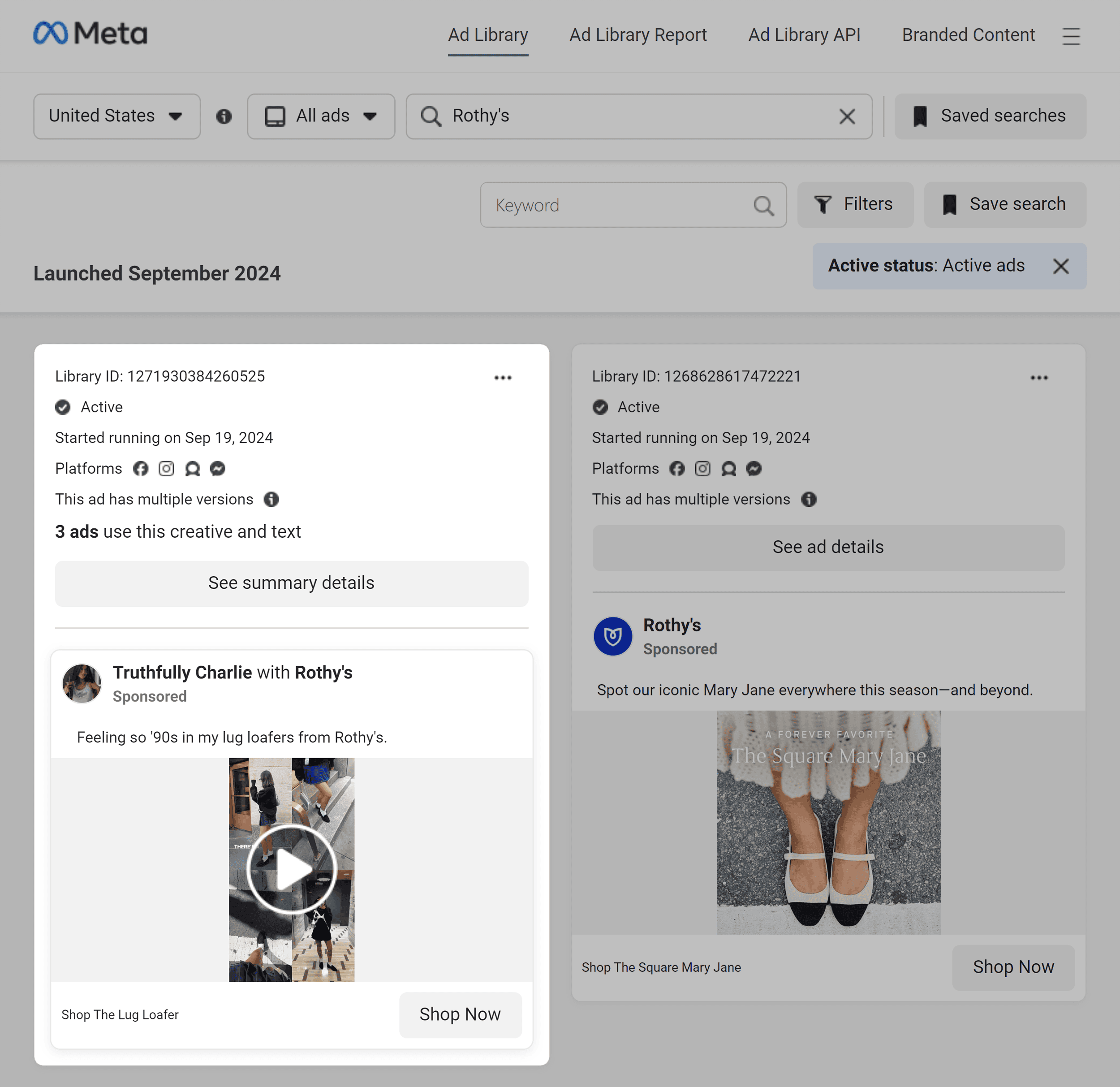

If you want to find your competitors’ ads, use sources like Meta Ads Library or LinkedIn Ads Library.

Depending on your industry, you can look at Amazon and Etsy ads. You can also use Semrush to see what keywords they’re bidding on for paid search.

Here’s an example from one of Rothy’s Meta ads:

It’s clear they’re running user-generated ads and social proof to drive more conversions. If you’re selling similar products, consider using such elements in your ad strategy.

For example, test ads with customer testimonials that include differentiators that customers have mentioned.

To examine their email marketing flows, either sign up for their email list or use tools like Unkover to automate that process.

You’ll get all their educational and promotional emails, so you can see how competitors market their products in real time. You could also use these emails as inspiration for your email strategy.

And don’t forget about offline marketing efforts.

Does your competitor attend trade shows or industry events? Do they use print advertising or direct mail? Or, are they investing in more brand partnerships?

It may be time to try something similar if you have the budget.

Once you have this data, benchmark it against competitors in your industry using tools like Semrush or Databox Benchmarks. These tools let you compare your marketing and advertising performance against chosen competitors and see how far ahead/behind you are.

Ultimately, dissecting their entire marketing and advertising strategy will also show you gaps in your own. You can redirect resources or change your strategy accordingly.

7. Study the Competitor’s Customer Journey

You want to see how easy (or hard) it is for customers to buy from your competitors.

Map the entire customer journey—from awareness to post-purchase support. This will help to identify friction points and opportunities for improvement in your own process.

Put yourself in the shoes of your competitor’s customers. Go through the process of:

- Discovering their brand

- Researching their products or services

- Making a purchase

- Using their product or service.

Pay attention to every touchpoint along the way.

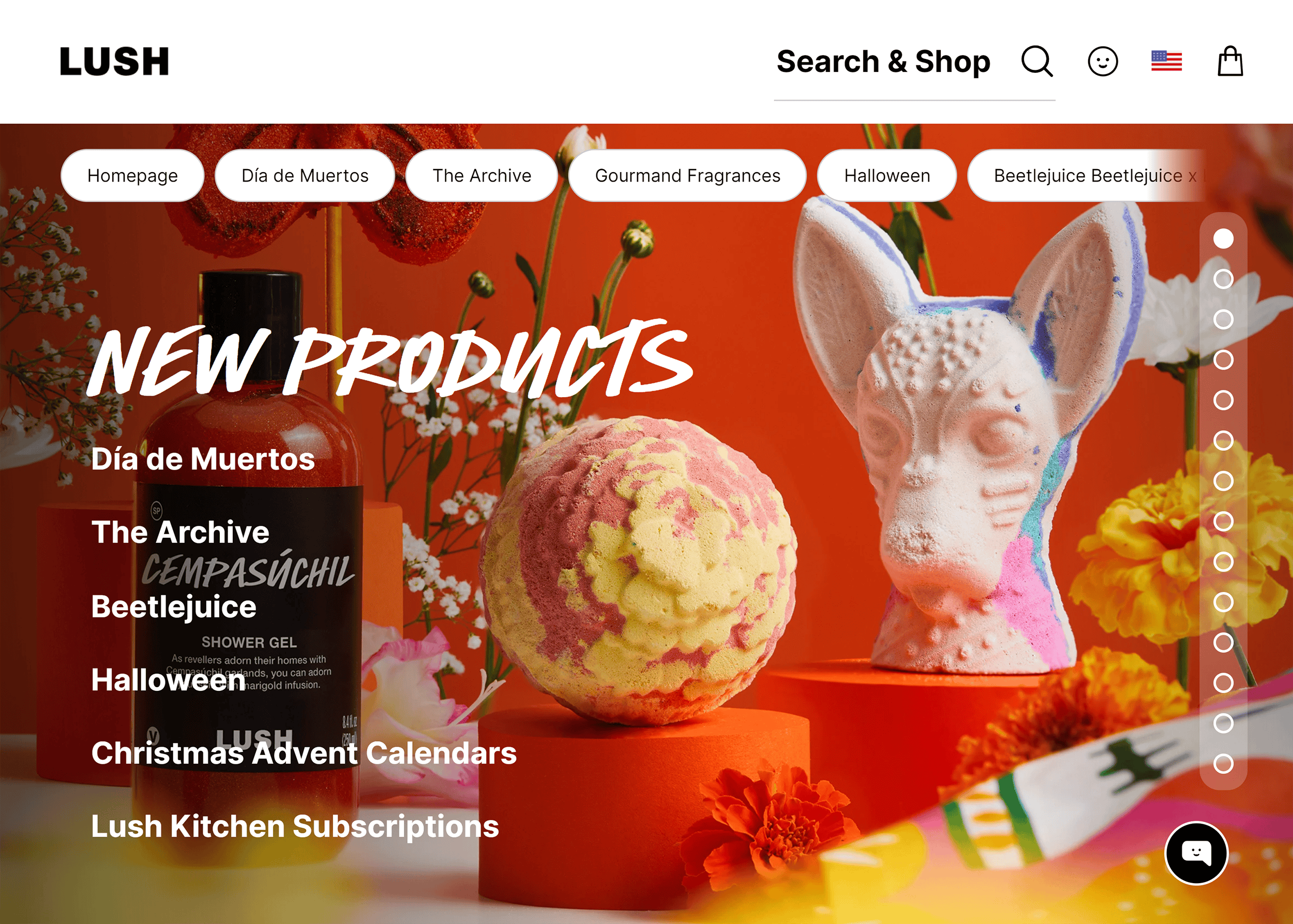

For instance, Lush Cosmetics’ website navigation can be a little complicated for new users.

Since all the product categories are listed on the top, users need to keep scrolling horizontally to find what they want.

Vertical navigation might have made the process much easier.

However, while finding the right product might be a bit challenging, Lush makes it easy to buy its products.

The product collections have an “Add to Bag” option, so you can add it directly instead of clicking on the page. They also offer a guest checkout option, reducing friction in the buying process.

To compete, you might offer similar purchase experiences—along with an easier website navigation menu.

Don’t forget about reviewing their retention strategies, too.

What does their support look like? Do they have a loyalty program? How do they encourage repeat purchases? What kind of follow-up do they do with existing customers?

These questions help you dig further into their approach—and how you differentiate from them.

For instance, Lush Cosmetics doesn’t currently offer an online loyalty program. If you sell similar products, this is an excellent strategy to get and keep more customers.

8. Uncover Your Competitor’s Technology Stack

Your competitor’s tech stack gives you an inside look into their current capabilities and areas of prioritization. Here are a few sources to find this data:

- Extensions like BuiltWith or Wappalyzer

- Public case studies

- Job postings

- Technical documentation

- Partner ecosystem

This information will let you identify potential areas for technological differentiation or operational efficiencies.

For instance, Backlinko uses tools like Wistia and YouTube to display videos on its website. If you want to start ramping up video production, consider similar tools.

9. Review Their Hiring Strategy

It’s always a good idea to research the people behind the company.

Start with websites like Glassdoor, LinkedIn, and Indeed. Read the reviews and see where the company is falling short.

Say employees complain about lack of benefits and work-life balance. You could offer compensation packages to attract (and retain) good talent.

Next, review their job postings.

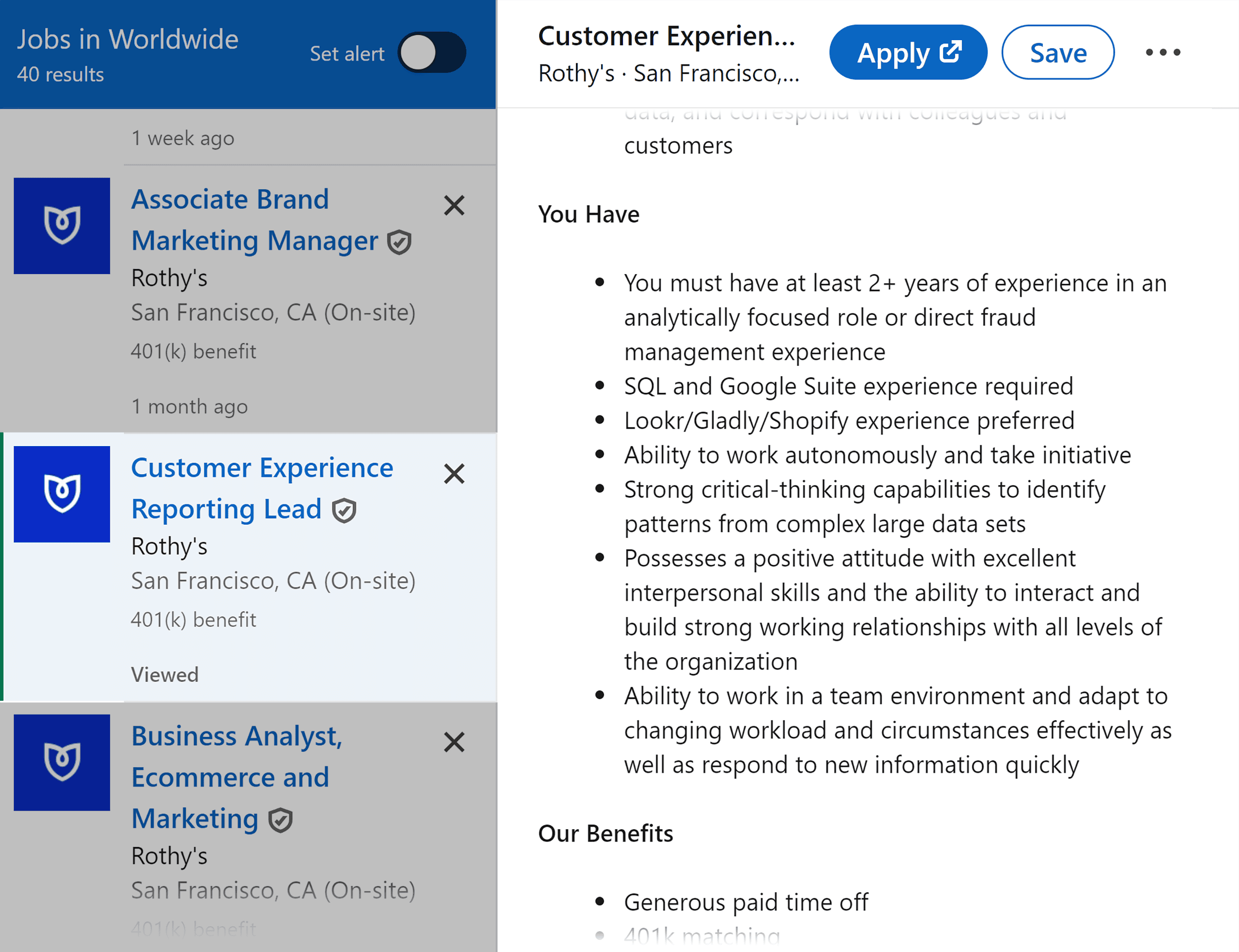

For example, Rothy’s is hiring for marketing roles indicating that customer acquisition is top of mind.

Monitoring job openings can provide insight into your competitor’s priorities and upcoming initiatives.

If they are hiring content strategists or social media managers, it may mean they want to expand their digital presence.

Competitive positioning consultant Talya Heller also recommends looking at the “People” tab on LinkedIn. Here, you can filter members by role, location, or education.

“Within a few minutes, you can see the ratio between engineering, marketing, sales, and support. It’s a great start to poke holes in their ability to innovate or support their customers.”

10. Talk to Their Customers

While employees are one side of the coin, customers are the other.

Andy McCotter-Bicknell has an unusual way to contact a competitor’s customers. He just messages them.

“There have been multiple research projects where I’ve messaged competitors’ customers on LinkedIn or via email asking for info. And I’m surprised how willing folks are each time to share their thoughts. As long as you’re transparent about who you are and who you work for, this should be a no-brainer.”

You could also speak to your existing customers who switched from your competitors. Federico Jorge, another competitive intelligence expert, recommends putting a Win/Loss program in motion for this.

Here’s how:

- Build a list of recent won/lost deals using data from your customer relationship management system (CRM)

- Reach out to them personally or via your salespeople, and invite them to a call (you might need to use incentives, especially for loss interviews)

- Conduct your interview, and record and transcribe the call

- Analyze the transcripts to look for insights and trends. Try using Dovetail for this.

- Report on your insights with your teams and refine

If you can’t reach customers, look at a competitor’s case studies or testimonials. Or, manually search for them on social media.

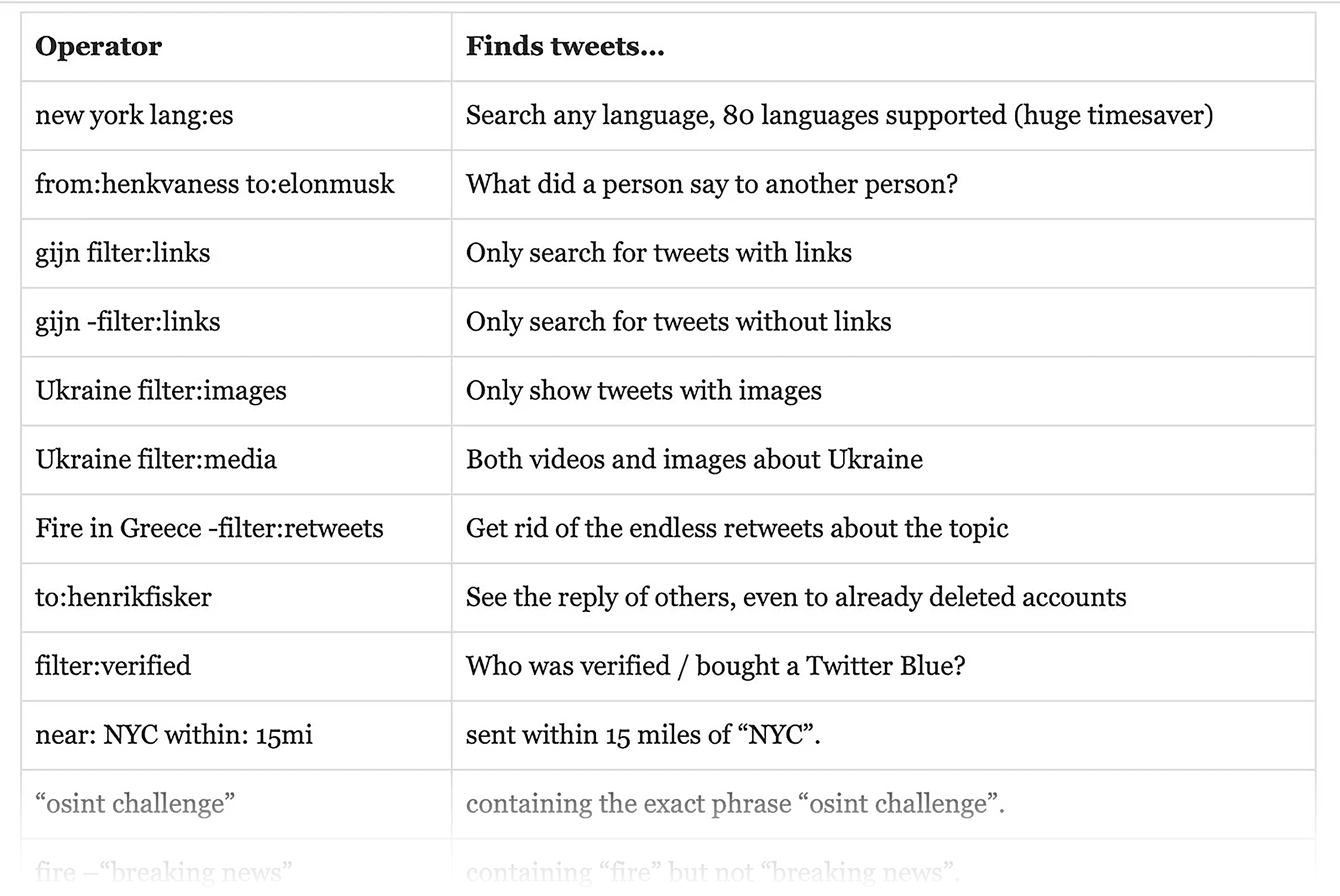

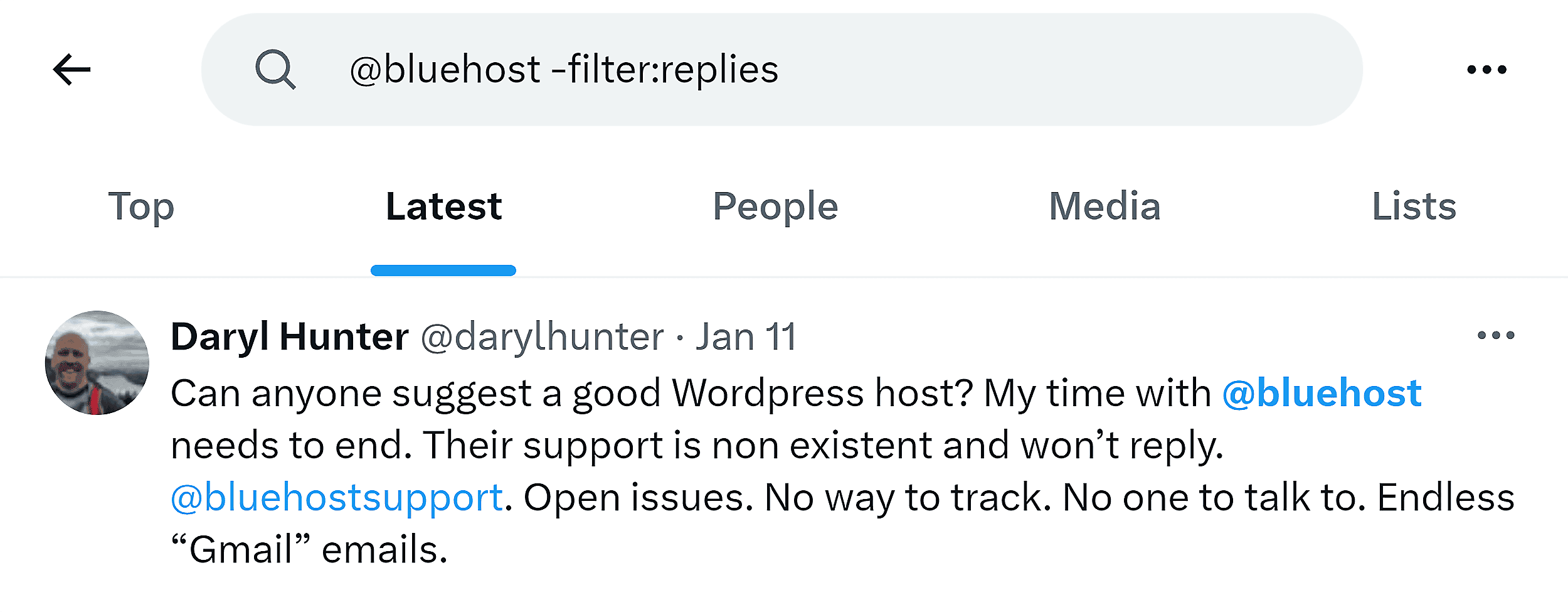

Seasoned marketer Andrea Bosoni recommends using advanced search operators on social media for this purpose.

Search operators work on search engines like Google and social media. Here are a few operators for X (formerly known as Twitter):@

Say you want to see how customers speak about a competitor’s product or interact with their social media account.

Here’s how Andrea does it:

- Use a search operator: @bluehost -filter:replies (this only filter replies to the Bluehost account)

- Sort the results by “Latest”

- Look for patterns

In this case, people complain about slow customer support. So, that’s something you can prioritize if you’re a WordPress competitor.

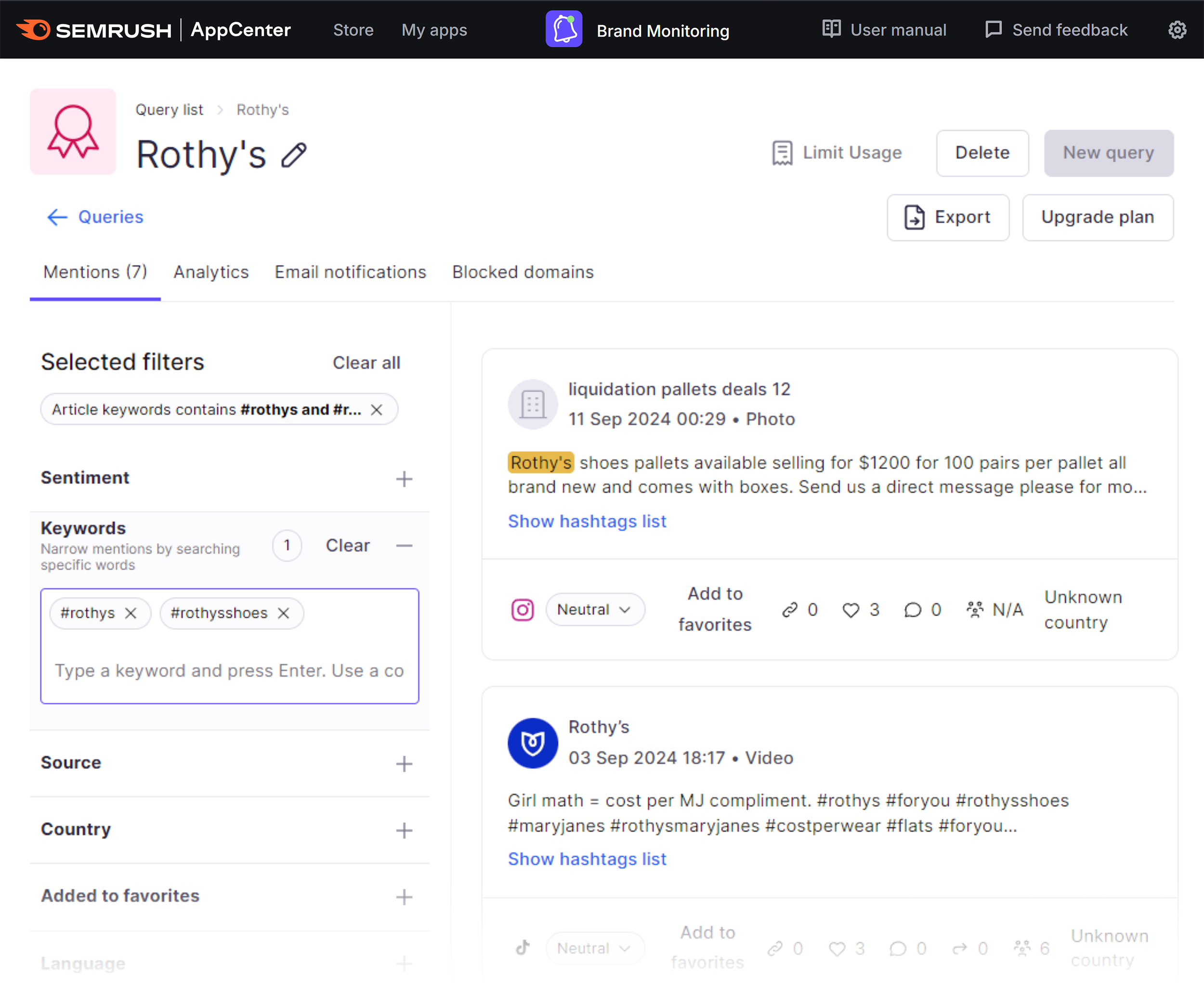

You could also use social listening tools to learn what people are saying about your competitors. These tools let you skip the manual analysis and glean insights faster.

For instance, Semrush’s Brand Monitoring app surfaces relevant conversations about competitors in one place.

Once you see how customers describe or discuss a competitor’s offer, you’ll see how they perceive your rival. Not just that, you’ll also poke holes into the brand’s shortcomings, giving you an opportunity to outdo them in that customer segment.

This information is also very useful for your own messaging and positioning exercise.

You can use the customer’s voice to describe your product/service properly and differentiate it in a language they understand.

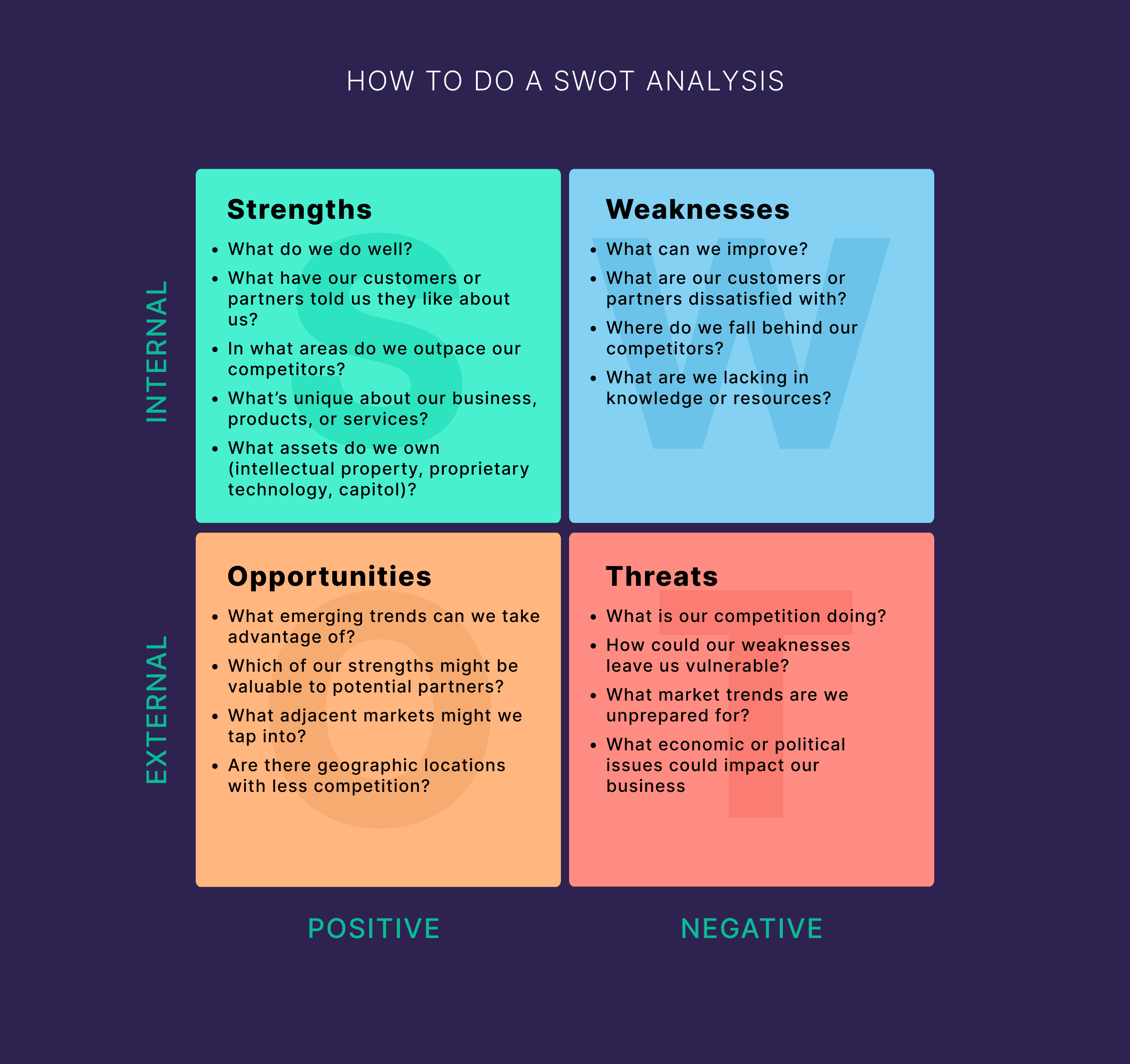

11. Categorize Findings Using SWOT Analysis

The last step is to list all your findings in a document or spreadsheet and find your:

- Strengths

- Weaknesses

- Opportunities

- Threats

This process, often referred to as the SWOT framework, helps you organize and understand your findings in a meaningful context.

Let’s say you find a certain brand has more customer support reps and expensive support technologies—that’s a strength.

But if customers complain about delivery times, the logistical issues would be a weakness.

Now, compare these two attributes to your brand.

Are your delivery times adequate? And do you have enough reps to handle support tickets?

If the answer is yes to both, it’s a strength for your brand. So, catalog that under the “Strength” part of the framework. If not, add it under “Weakness” or “Threat.”

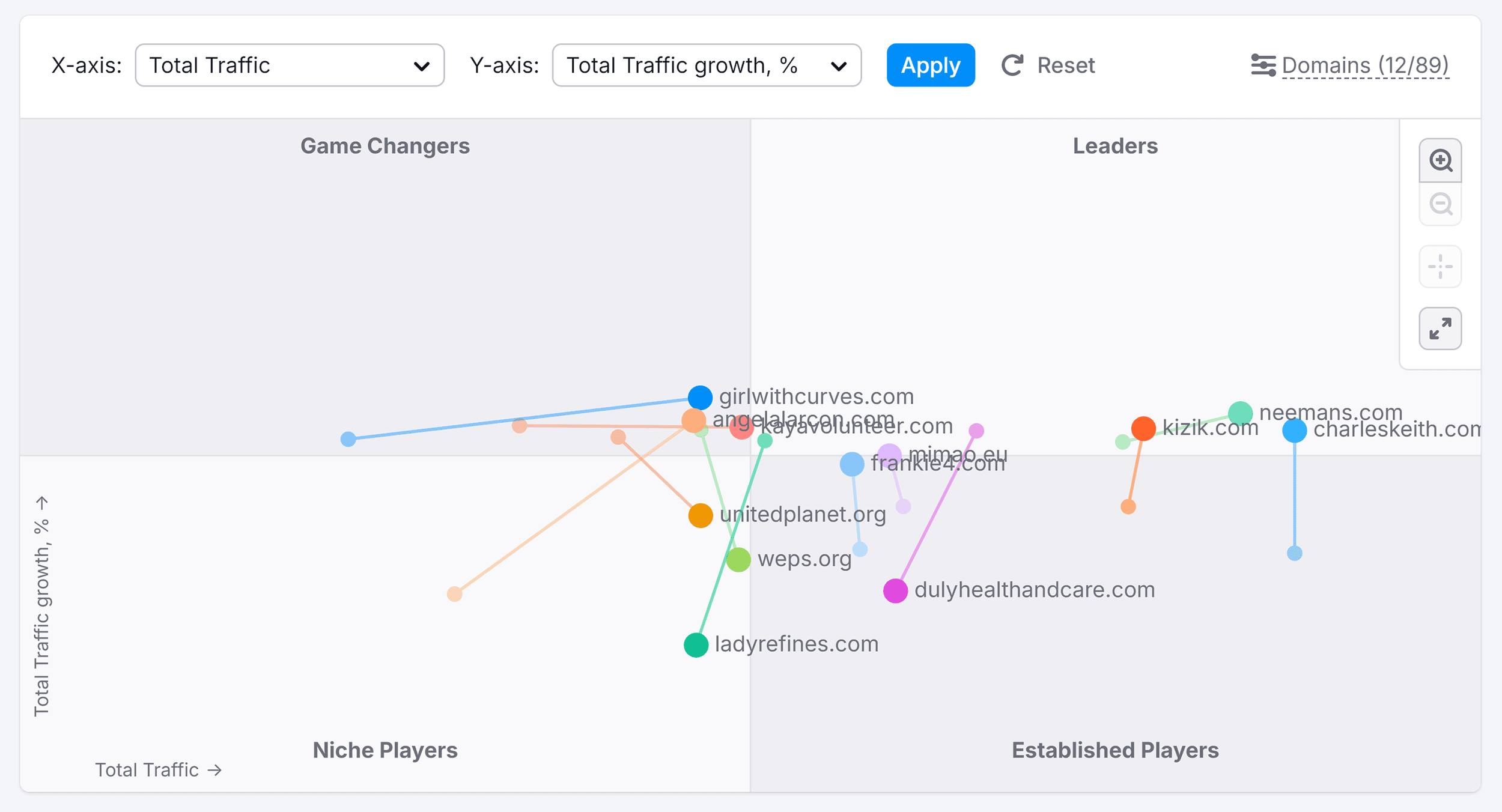

You could also add another layer to the SWOT process. If you’re benchmarking website growth using Market Explorer, you can categorize brands into buckets like:

- Leaders (significant growth and traffic)

- Game Changers (stagnant or declining traffic)

- Established players (steady flow of traffic that’s stagnant)

- Niche players (minimal traffic and traffic growth)

Here’s an example for relevant search competitors for Rothys:

Similarly, pick your criteria for mapping these vectors and visualize your peers based on the metrics that matter the most to you.

By mapping out your competitors, you’ll see what’s working in your market and where to grow. More importantly, you can identify the areas where you need to strengthen your brand.

With this detail, the SWOT analysis is more than an organizational tool. It’s a roadmap to beat your competition and seize missed opportunities.

Who Benefits from Competitor Research?

Competitor research stands to benefit the entire business—not just particular teams.

The problem?

We tend to use a department-specific lens for it.

Federico Jorge says one of the biggest mistakes businesses make is doing this process in isolation. Instead, he recommends involving the entire organization from the start.

“Involve stakeholders from different departments (sales, product, marketing) that understand the space and competitors well. You can lean on this ’board of experts’ and share information as you find it.”

When you get this data, put it into context for each function and use it to your advantage.

Here’s what it looks like for different teams:

Founders

Founders can use competitive intel to see how their business fits into the larger market. And get a birds-eye overview of competitors’:

- Strategic direction

- Resource allocation

- Long-term goals

- Strengths

- Weaknesses

- Differentiators

Use that data to create benchmarks against competitors and see where you stand.

Ideally, you’re trying to find the “wedge” in the market that’s less competitive. For example, a missing use case or underserved audience segment.

But you need competitive intelligence to find that and use it as a way to grow your business.

Product Teams

Creating a product without sizing up the competition is like driving blindfolded.

You won’t know how to make your offering stand out.

Here’s what you can do instead:

- Dissect your rivals’ products. Take a close look at their features and capabilities.

- Find the gaps. What customer needs are they missing?

- Discover your “wedge.” This is your opportunity to shine in the market.

Let’s look at a well-known example: Airbnb.

The founders noticed that hotels book up fast before big events.

So they turned their own home into a temporary hotel room.

This simple initiative resonated with guests looking for affordable accommodation. And just like that, Airbnb was born.

The takeaway?

Use competitive intel to uncover unmet needs in your market. Sometimes, it might even create entirely new product categories.

Marketing and Advertising Teams

For marketers and advertisers, competitive research is an opportunity to:

- Refine messaging

- Identify potential channels

- Surface new trends

- Experiment with new content

You don’t want to get lost in the sea of sameness, nor do you want to offer the same content as your competitors. That’s where competitive research comes in handy.

Take Dollar Shave Club, for example.

When they entered the razor market, it was dominated by big brands like Gillette and Schick. These giants were known for flashy TV commercials featuring sports stars and high-tech razor designs.

Dollar Shave Club did their homework. They realized that consumers were frustrated with overpriced razors and overwhelming choices.

So what did they do?

They zigged while others zagged.

Instead of glossy TV ads, Dollar Shave Club launched with a low-budget, humorous YouTube video. The video went viral, accumulating millions of views.

Their message? Simple, affordable razors delivered to your door.

This approach was a direct response to their competitors’ complex, expensive offerings.

The result?

Dollar Shave Club disrupted the industry and gained market share. It was later sold to Unilever for $1 billion.

Takeaway:

Competitive research doesn’t just tell you what others are doing. It helps you find unique ways to stand out.

Sales Teams

Sales representatives can use competitive analysis to:

- Refine their pitches

- Identify differentiators

- Understand prospect needs

- Strategize different outreach strategies

Let’s say you sell an ecommerce platform for mom-and-pop shops.

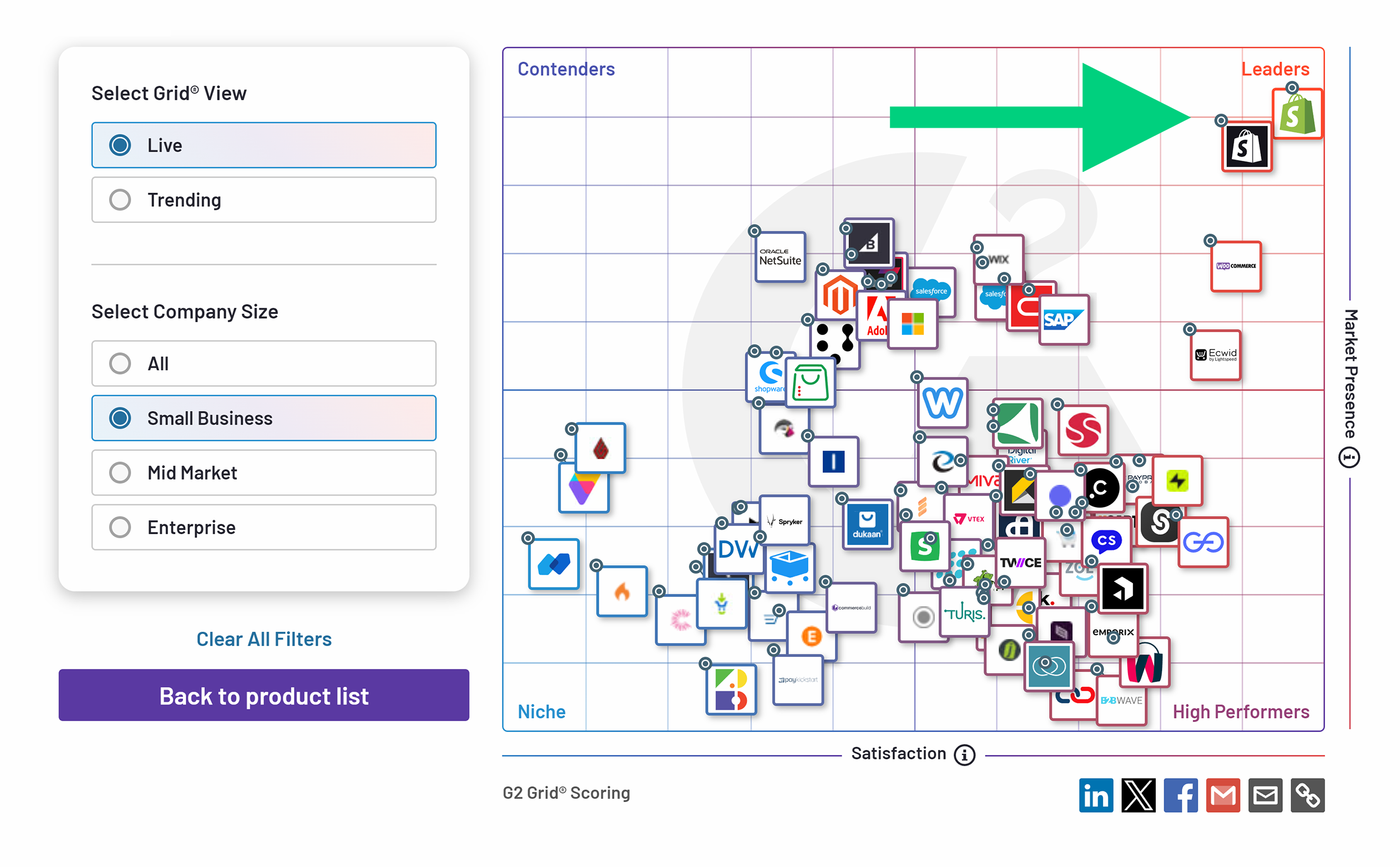

Use third-party review sites like G2 to identify leading and contending competitors based on customer sentiment.

In the G2 grid below, we can see that Shopify is a clear leader in this category. This makes sense as it offers multiple plans for small businesses and is easy to set up compared to solutions like Salesforce or Oracle Cloud.

Use that information as a baseline to see who your prospects compare you to. Study these companies and find ways you stand out. That’ll give you new communication points for your next sales call.

Human Resources Teams

Human resources (HR) teams can use competitive research for:

- Identifying a competitor’s strategic priorities (like marketing, etc.)

- Benchmarking salary and compensation data

- Observing how they communicate with and treat employees

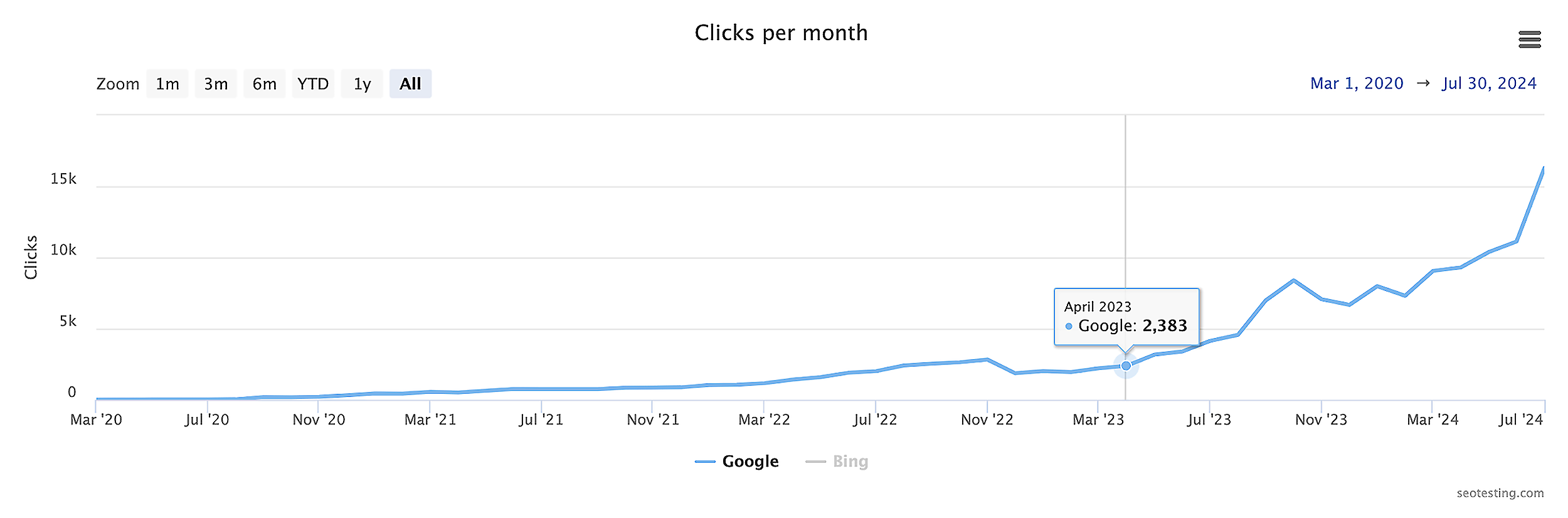

In 2023, SEOTesting founder Nick Swan made an important hire. This was in response to competitors ramping up content production.

He knew he had to hire a marketing manager to improve his market presence in the next year or so.

Fast-forward to 2024, and the new recruit worked out.

Within 15 months, SEOTesting grew its organic traffic to nearly 17,000 clicks a month—which also increased monthly revenue.

The lesson?

Competitive research can guide HR in making strategic hires that align with industry trends and priorities.

By observing competitors’ growth initiatives and team expansions, HR teams can identify key roles needed to stay competitive.

Customer Support Teams

Customer support (CS) teams use competitive intel to:

- Benchmark service quality

- Identify potential areas for improvement

- Learn about new technologies

- Hone in on product/service differentiators

- Create onboarding and support materials

Let’s say your competitor’s customers report that their support is excellent. It’s time to dig into why.

Are they using AI chatbots for speedy service? Are they offering more onboarding or self-service support? Are they hiring more regional support reps?

The answers could surprise you—and potentially change your CS strategy too.

Monitor Your Competitors to Stay Ahead

Remember that competitive research isn’t a one-and-done task. Set up a regular cadence to run this process—maybe once a month or quarter, depending on the pace of your industry.

The more you keep tabs on your competitors, the easier it’ll be to truly stay ahead of them.

Ready to start researching your rivals?

Use this spreadsheet template to document your findings and size up your business against its competitors.

Reveal any company’s website traffic

Spy on your competitors’, prospects’, and potential partners’ website traffic.